Are you thinking about how to start a real estate investment business? You’re not alone! Many people are diving into real estate, eager to capitalize on the lucrative market. Did you know that real estate has historically appreciated in value over time, making it a solid investment choice?

Real estate investment involves purchasing properties to generate income or appreciation. Whether you’re interested in residential or commercial properties, the potential for profit is significant. In this article, we’ll cover:

- Understanding real estate investment

- Essential steps to get started

- Market research and analysis techniques

- Funding options for your investments

- Creating a solid business plan

- Building a team for success

1. What is Real Estate Investment and Why Start Now?

Understanding what real estate investment truly means is the first step in your journey. Essentially, it’s about buying properties with the intention of making a profit, either through rental income or property appreciation. Starting now is key; the earlier you begin, the more you can benefit from market growth.

Here are some compelling reasons to start investing in real estate today:

- Passive Income: Rental properties can provide a steady stream of income.

- Appreciation: Properties typically increase in value over time.

- Diversification: Real estate can diversify your investment portfolio.

So, if you’re ready to take the plunge, let’s explore how to build a solid foundation for your real estate investment business.

2. Develop Your Investment Strategy for Real Estate

When you’re figuring out how to start a real estate investment business, having a solid investment strategy is crucial. You need to decide whether you want to focus on residential, commercial, or rental properties.

Here are a few strategies to consider:

- Buy and Hold: This strategy involves purchasing properties and renting them out for steady cash flow. It’s a long-term investment approach that can yield significant returns over time.

- Flipping: If you enjoy renovation projects, flipping properties might be for you. This strategy involves buying properties, improving them, and selling them for a profit.

- REITs: Real Estate Investment Trusts are a more hands-off approach where you invest in a company that owns and manages real estate. This option is great for those looking to invest without managing properties directly.

Ultimately, your strategy should align with your financial goals and risk tolerance. Remember, each approach has its pros and cons, and it’s essential to choose one that fits your lifestyle and investment objectives.

In conclusion, developing a clear investment strategy is a foundational step in your journey of how to start a real estate investment business. It sets the stage for your future decisions and guides your actions in the competitive world of real estate investing.

3. Conduct Market Research for Real Estate Investments

Understanding the market is key when learning how to start a real estate investment. Conducting thorough market research can help you identify the best locations and property types to invest in. This process is crucial because it allows you to make informed decisions that can significantly impact your investment success.

Here are some effective methods to conduct market research:

| Research Method | Description |

|---|---|

| Online Research | Use websites like Zillow or Realtor.com to gather data on property values, trends, and neighborhood statistics. |

| Local Market Analysis | Visit neighborhoods to assess property conditions, rental demand, and local amenities. Observing the area in person can provide insights that online research might miss. |

| Networking | Connect with local real estate agents, investors, and property managers to gather insights and tips about the market. They can offer valuable information that might not be publicly available. |

Additionally, consider analyzing demographic trends, employment rates, and economic indicators in the areas you are interested in. This data can help you gauge future property demand and appreciation potential.

By conducting thorough market research, you can better position yourself for success in your real estate investment journey. Remember, knowledge is power!

4. Create a Detailed Business Plan for Your Real Estate Investment

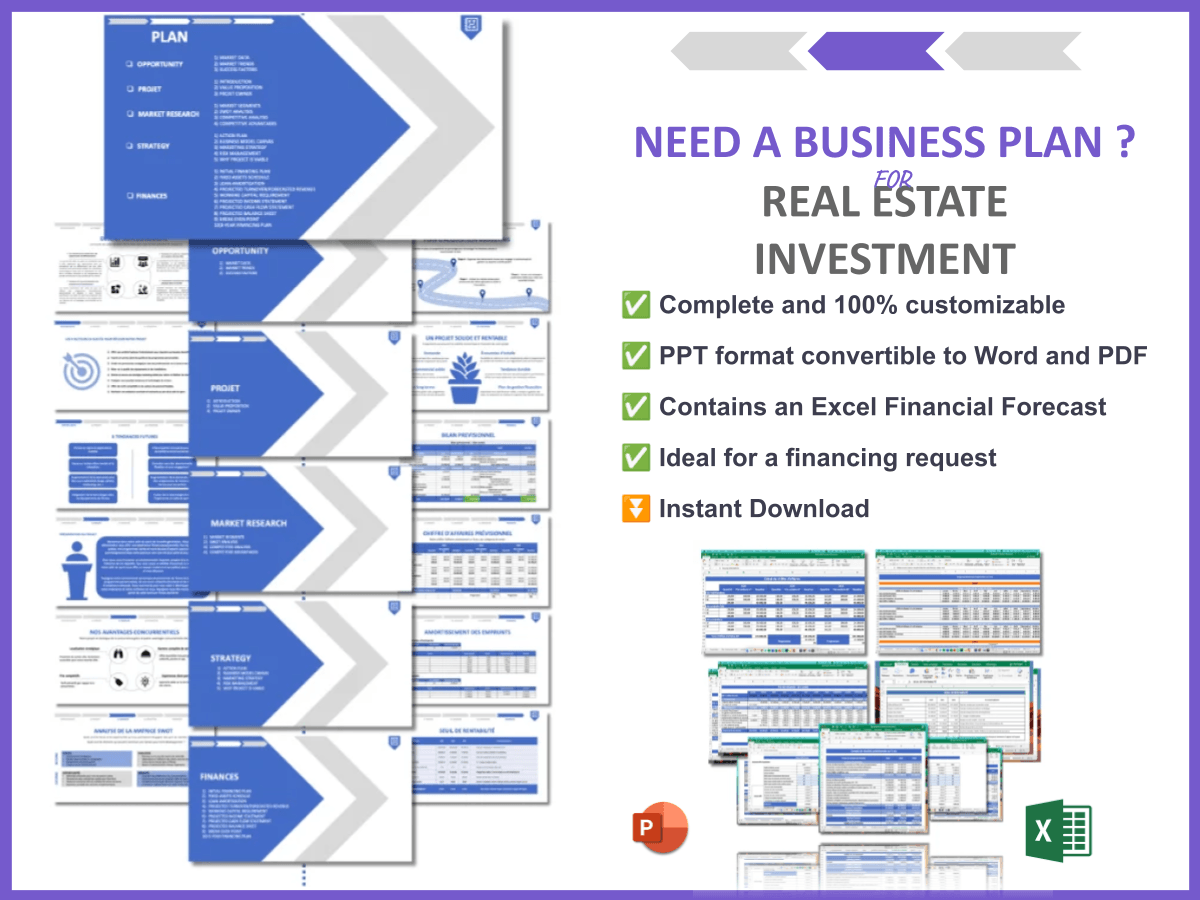

Writing a business plan is an essential step in how to start a real estate investment business. It serves as a roadmap for your investments and can help attract investors or lenders. A well-structured business plan outlines your vision, goals, and the strategies you’ll employ to achieve them.

Your plan should include:

- Executive Summary: A brief overview of your business concept, including your mission and objectives.

- Market Analysis: A detailed examination of your target market, including trends, opportunities, and potential challenges.

- Financial Projections: A forecast of your expected revenue, expenses, and profitability over the next few years.

Additionally, consider including sections on your marketing strategy, operational plan, and risk management. Each component should reflect your unique approach to real estate investment.

I recommend checking out this business plan template for Real Estate Investment. It’s super detailed and can save you a ton of time! Having a solid business plan not only helps you stay focused but also demonstrates to potential investors that you are serious and prepared.

In summary, creating a detailed business plan is a foundational step in launching your real estate investment business. It guides your decisions and helps you navigate the complexities of the real estate market.

5. Choose the Right Legal Structure for Your Business

Deciding on the legal structure of your business is crucial when learning how to start a real estate investment. The structure you choose will affect your taxes, liability, and how you raise capital. There are several options to consider, each with its pros and cons.

Here’s a quick breakdown of common legal structures for real estate investment:

| Structure | Pros | Cons |

|---|---|---|

| LLC (Limited Liability Company) | Provides limited liability protection, flexible tax treatment, and is relatively easy to set up. | May have higher startup costs and requires more paperwork than a sole proprietorship. |

| Partnership | Simple to establish, allows for shared resources and expertise, and can provide easier access to capital. | Shared liability and potential conflicts between partners. |

| Corporation | Offers strong liability protection and easier access to capital through stock sales. | More complex to set up and maintain, with potential double taxation on profits. |

Choosing the right structure depends on your investment goals, the level of risk you’re willing to take, and your financial situation. Consulting with a legal or financial professional can help you make the best choice for your real estate investment business.

6. Secure Funding for Your Real Estate Investments

Funding your real estate investments is one of the biggest hurdles when figuring out how to start a real estate investment business. You have several options available, and understanding these can help you secure the necessary capital.

Here are some popular funding sources to consider:

- Traditional Mortgages: Ideal for purchasing residential properties, these loans usually offer lower interest rates and longer repayment terms.

- Hard Money Loans: These are short-term loans secured by real estate. They are quicker to obtain but typically come with higher interest rates.

- Private Investors: Friends, family, or private investors who want to collaborate can be a great source of funding. Make sure to outline clear terms to avoid misunderstandings.

- Real Estate Crowdfunding: Platforms allow you to pool money with other investors to fund a property. This can be a good way to get involved without needing a large amount of capital upfront.

Evaluate each option carefully to find the best fit for your financial situation and investment strategy. Consider your long-term goals and how each funding source aligns with them. Securing the right funding is essential for your success in the real estate investment landscape.

7. Register Your Business to Make It Official

Once you’ve established your business structure, it’s time to register your business. This step is vital when learning how to start a real estate investment. Registering your business not only legitimizes your operations but also protects your personal assets.

Follow these steps to ensure a smooth registration process:

- Choose a Business Name: Select a unique name that reflects your brand and is not already in use. Check local and state databases to confirm availability.

- File the Necessary Paperwork: Depending on your chosen structure, you may need to file Articles of Organization for an LLC or Articles of Incorporation for a corporation with your state’s Secretary of State.

- Obtain an Employer Identification Number (EIN): This number is necessary for tax purposes and is required if you plan to hire employees.

- Open a Business Bank Account: Keep your business finances separate from personal ones by opening a dedicated bank account for your real estate investment business.

Taking these steps will help you establish a solid legal foundation for your real estate investment business, ensuring compliance with local laws and regulations.

8. Obtain Necessary Permits and Licenses for Real Estate Investment

Depending on your location and the nature of your investments, you may need various permits and licenses to operate legally. This is an important part of how to start a real estate investment business. Failing to secure the necessary documentation can lead to fines or even legal issues down the line.

Here’s a checklist of common permits and licenses you might need:

- Business License: Required in most jurisdictions to operate any business legally.

- Real Estate License: If you plan to buy and sell properties or manage rentals professionally, you’ll likely need a real estate license. This typically involves completing a course and passing an exam.

- Rental Permits: If you’re planning to rent out properties, check if your city or county requires rental permits or inspections.

- Property-Specific Permits: Depending on your projects, you might need permits for renovations, zoning, or building codes. Always check local regulations.

Research local requirements to ensure you have all necessary permits and licenses before launching your real estate investment business. Staying compliant will not only save you from potential headaches but also build credibility with your clients and investors.

9. Set Up Your Financial Management Systems

Keeping track of your finances is crucial in how to start a real estate investment. Implementing effective financial management systems can help you monitor your income, expenses, and overall profitability. Here are some key components to consider:

- Bookkeeping: Use accounting software like QuickBooks or FreshBooks to track your transactions and maintain accurate records. This will save you time and headaches during tax season.

- Budgeting: Create a detailed budget for your business. This should include projected income, operating expenses, and potential costs associated with property management or renovations.

- Tax Preparation: Understand your tax obligations and consider hiring a tax professional who specializes in real estate. This can help you maximize deductions and ensure compliance with tax laws.

To further enhance your financial management, consider using the following tools:

| Tool | Purpose |

|---|---|

| Accounting Software | Track income, expenses, and generate financial reports. |

| Property Management Software | Manage tenants, leases, and maintenance requests. |

| Spreadsheet Programs | Create custom budgets and financial forecasts. |

By setting up solid financial management systems, you can gain valuable insights into your real estate investment business and make informed decisions that drive your success.

10. Establish Your Brand Identity in Real Estate

Your brand is your business’s identity, and establishing it is a critical step when learning how to start a real estate investment. A strong brand can help you stand out in a competitive market and build trust with potential clients and investors.

To create a compelling brand identity, focus on the following elements:

- Logo and Color Scheme: Design a professional logo and choose a color palette that reflects your brand’s personality. This visual representation will be used on your website, marketing materials, and business cards.

- Mission Statement: Clearly articulate your mission and values. This statement should convey what your business stands for and the unique value you offer to your clients.

- Target Audience: Identify your ideal clients and tailor your branding efforts to resonate with them. Understanding their needs and preferences will help you craft messages that connect.

Additionally, consider how you want to communicate with your audience. A consistent tone of voice across all platforms—whether it’s formal, friendly, or professional—will reinforce your brand identity.

Building a strong brand identity not only helps in attracting clients but also establishes credibility and fosters long-term relationships in the real estate investment industry.

11. Develop a Professional Website for Your Real Estate Business

In today’s digital age, having a professional website is essential. It’s a key step in how to start a real estate investment business. Your website serves as the online face of your brand and is often the first point of contact for potential clients and investors.

Your website should include:

- Property Listings: Showcase available properties with high-quality images, detailed descriptions, and pricing information. This is crucial for attracting buyers or renters.

- Contact Information: Make it easy for visitors to get in touch with you. Include a contact form, phone number, and email address prominently on your site.

- Blog or Resources: Share valuable content related to real estate investing, market trends, and tips for buyers and sellers. This not only establishes your expertise but also improves your website’s SEO.

Additionally, ensure your website is mobile-friendly and optimized for search engines. A responsive design will enhance user experience and increase your chances of ranking higher in search results.

Investing in a professional website is an investment in your real estate investment business, helping you reach a wider audience and build credibility in the market.

12. Market and Advertise Your Real Estate Investment Business

Once your business is set up, it’s time to market it! This is a crucial part of how to start a real estate investment. Effective marketing strategies will help you attract clients, generate leads, and ultimately close deals.

Consider using the following marketing techniques:

- Social Media Platforms: Leverage platforms like Facebook, Instagram, and LinkedIn to promote your properties and connect with potential clients. Share engaging content, including property tours and client testimonials.

- Email Marketing: Build an email list of interested prospects and send regular newsletters with updates on new listings, market insights, and investment tips.

- Networking Events: Attend local real estate events, conferences, or meetups to connect with other professionals and potential investors. Building relationships can lead to referrals and new opportunities.

Additionally, consider investing in online advertising, such as Google Ads or Facebook Ads, to target specific audiences and increase your visibility. A well-rounded marketing strategy will position your real estate investment business for success in a competitive market.

13. Assemble Your Team for Real Estate Success

Having a great team can make or break your real estate investment business. When figuring out how to start a real estate investment, think about the key roles you need to fill to support your operations and growth.

Consider hiring:

- Real Estate Agents: They can help you find and negotiate property deals, as well as connect you with potential buyers or tenants.

- Property Managers: If you plan to own rental properties, a property manager can handle day-to-day operations, tenant relations, and maintenance issues.

- Financial Advisors: Having a financial expert on your team can help you make informed decisions regarding funding, investments, and financial planning.

Building a strong team will help you navigate the complexities of real estate investing. Surrounding yourself with knowledgeable professionals will enhance your chances of success and provide valuable insights into the market.

In conclusion, assembling the right team is a critical step in establishing a successful real estate investment business. With the right support, you can achieve your investment goals and thrive in the competitive world of real estate.

Conclusion

In summary, starting a real estate investment business requires careful planning, strategic decision-making, and a commitment to continuous learning. By following the steps outlined in this guide—from developing your investment strategy to assembling a strong team—you can position yourself for success in the dynamic world of real estate.

As you continue on your journey, consider exploring additional resources that can enhance your knowledge and skills. For instance, check out our article on how to create a SWOT Analysis for Real Estate Investment, which can help you identify strengths, weaknesses, opportunities, and threats in your business. Additionally, our article on How to Formulate a Real Estate Investment Marketing Plan? With Example provides valuable insights into effectively promoting your investment opportunities.

With dedication and the right strategies, you can achieve your real estate investment goals and enjoy the rewards that come with it.

FAQ

- What is real estate investment?

Real estate investment involves purchasing properties with the intent to generate income or appreciate in value. Investors can earn money through rental income, property appreciation, or both. - How much money do I need to start investing in real estate?

The amount needed varies based on the type of investment. Some properties can be acquired with as little as 3% down, while others may require larger investments. It’s essential to evaluate your financial situation and funding options. - What are the different types of real estate investments?

Common types of real estate investments include residential properties, commercial real estate, real estate investment trusts (REITs), and rental properties. Each type has its unique advantages and risks. - How do I find good investment properties?

Finding good investment properties involves thorough market research, networking with local real estate agents, and utilizing online platforms to identify potential deals. Consider factors such as location, property condition, and market trends. - What is a real estate investment strategy?

A real estate investment strategy is a plan that outlines how an investor intends to achieve their investment goals. Common strategies include buy-and-hold, flipping, and investing in rental properties. - Do I need a real estate license to invest in properties?

Generally, you do not need a real estate license to invest in properties. However, if you plan to buy and sell properties professionally or manage rentals, obtaining a license may be beneficial. - What are the risks associated with real estate investment?

Risks include market fluctuations, property damage, tenant issues, and unexpected expenses. Conducting thorough research and having a solid financial plan can help mitigate these risks. - How can I finance my real estate investments?

Financing options include traditional mortgages, hard money loans, private investors, and real estate crowdfunding. Each option has its pros and cons, so evaluate what works best for your situation. - What should I include in my real estate business plan?

A real estate business plan should include an executive summary, market analysis, financial projections, marketing strategies, and operational plans. A well-structured plan is crucial for guiding your business and attracting investors. - How can I market my real estate investment business?

Effective marketing strategies include utilizing social media, email marketing, attending networking events, and creating a professional website. Consistent branding and outreach efforts are key to attracting clients and investors.