Why Should You Have a SWOT Analysis for an Insurance Agency?

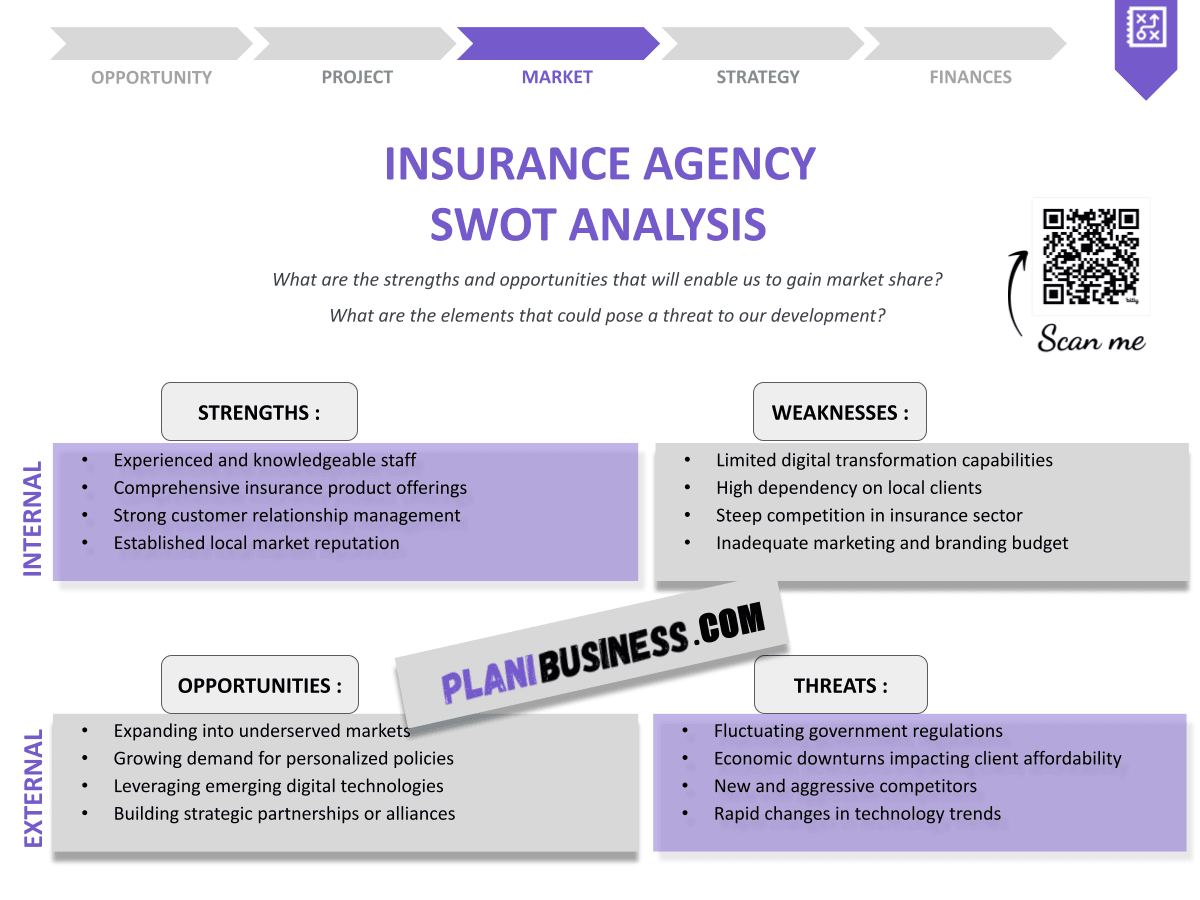

Are you ready to elevate your insurance agency’s performance? You’re not alone! Many agencies struggle to navigate the competitive landscape. An unexpected statistic reveals that over 70% of insurance agencies fail to leverage their strengths effectively. This article will dive into why a SWOT analysis is crucial for your agency’s success. A SWOT analysis is a strategic planning tool that identifies Strengths, Weaknesses, Opportunities, and Threats related to your business.

Understanding the significance of a SWOT analysis can transform your approach to strategic planning. Here are some key reasons why your insurance agency should conduct one:

- Identifies strengths unique to your agency, allowing you to capitalize on them.

- Recognizes common weaknesses in the insurance sector that you can address.

- Discovers opportunities in emerging markets that can drive growth.

- Assesses potential threats in the insurance landscape to prepare for challenges.

- Enhances your agency’s strategic direction and decision-making.

- Promotes team collaboration and input in evaluating the agency’s position.

- Facilitates continuous improvement by regularly reviewing your SWOT.

- Provides a framework for setting realistic goals and objectives.

- Helps in resource allocation based on strengths and opportunities.

- Guides the development of effective marketing strategies.

How Do You Write a SWOT Analysis for an Insurance Agency?

Writing a SWOT analysis for your insurance agency involves a structured approach that emphasizes collaboration and honest evaluation. Here’s a step-by-step guide on how to effectively create a SWOT analysis:

Strengths

Begin by identifying what sets your agency apart. Perhaps it’s your experienced team or a strong local presence. Consider these aspects:

- Customer service reputation: Satisfied clients often lead to referrals.

- Product offerings: Unique policies can attract niche markets.

- Technological capabilities: Modern tools can enhance efficiency and customer engagement.

Weaknesses

Next, acknowledge areas where you may fall short. This step is crucial for improvement:

- Marketing resources: Limited budgets can hinder visibility.

- Employee expertise: Gaps in knowledge can impact performance.

- Customer feedback: Look at recurring complaints to identify issues.

Opportunities

Explore potential areas for growth. Opportunities can be identified through market research:

- New markets: Identify regions or demographics that are currently underserved.

- Trends: Consider shifts in consumer behavior that could benefit your agency.

- Technological advancements: Innovations can streamline operations and improve service.

Threats

Finally, examine external factors that could pose risks to your agency:

- Competition: Analyze the competitive landscape in your area.

- Regulatory changes: Stay informed about laws that could impact your operations.

- Economic factors: Consider how economic downturns may affect your clients’ purchasing power.

By following these steps, you can create a comprehensive SWOT analysis that not only highlights your agency’s current position but also sets the stage for future success.

SWOT Example N°1 for an Insurance Agency

Let’s explore a detailed example to illustrate how to conduct a SWOT analysis effectively for an insurance agency. This example highlights various aspects that can significantly impact your agency’s strategy.

| SWOT | Analysis |

|---|---|

| Strengths | Established reputation, diverse product range |

| Weaknesses | Limited online presence, small marketing budget |

| Opportunities | Growing demand for digital insurance services |

| Threats | Increasing competition from online insurers |

- Established reputation: The agency has built trust within the community, leading to a loyal client base.

- Diverse product range: Offering various insurance products caters to different customer needs.

- Limited online presence: A small digital footprint can hinder attracting new clients.

- Growing demand for digital services: There’s an increasing interest in online insurance solutions.

- Conducting this analysis can reveal both the potential and pitfalls of your current strategy. It’s essential to capitalize on strengths while addressing weaknesses to seize opportunities and mitigate threats.

SWOT Example N°2 for an Insurance Agency

Let’s look at another scenario that broadens our understanding of conducting a SWOT analysis for an insurance agency. This example provides insights into how different elements can affect your strategy.

| SWOT | Analysis |

|---|---|

| Strengths | Personalized customer service, local expertise |

| Weaknesses | Dependence on a few key clients |

| Opportunities | Expansion into new geographic areas |

| Threats | Economic downturn impacting client renewals |

- Personalized customer service: The agency is known for its exceptional service, fostering strong client relationships.

- Local expertise: Understanding the community’s needs enhances the agency’s appeal.

- Dependence on key clients: Relying too heavily on a few clients can pose risks to revenue stability.

- Economic downturn: Financial instability can lead to clients reevaluating their insurance needs.

- This example highlights how local knowledge can be a double-edged sword. While it strengthens client relationships, over-reliance on key clients can create vulnerabilities.

SWOT Example N°3 for an Insurance Agency

Here’s a third example that offers unique insights into conducting a SWOT analysis for an insurance agency. This example emphasizes the importance of innovation and adaptability.

| SWOT | Analysis |

|---|---|

| Strengths | Innovative products, strong digital marketing |

| Weaknesses | High employee turnover |

| Opportunities | Increasing awareness of insurance needs post-COVID |

| Threats | Cybersecurity risks |

- Innovative products: The agency offers cutting-edge insurance solutions that cater to modern consumer needs.

- Strong digital marketing: Effective online strategies enhance brand visibility and engagement.

- High employee turnover: Frequent staff changes can disrupt service continuity and client relationships.

- Cybersecurity risks: As the agency increases its digital presence, it faces potential threats to data security.

- This analysis underscores the importance of innovation in a changing market. By leveraging strengths in product development and marketing, the agency can position itself as a leader while addressing vulnerabilities related to employee retention and cybersecurity.

SWOT Example N°4 for an Insurance Agency

Here’s another illustrative case to consider when conducting a SWOT analysis for your insurance agency. This example highlights the value of training and brand recognition.

| SWOT | Analysis |

|---|---|

| Strengths | Comprehensive training programs for agents |

| Weaknesses | Limited brand recognition |

| Opportunities | Rising interest in bundled insurance products |

| Threats | Competitive pricing from competitors |

- Comprehensive training programs: The agency invests in developing its agents, ensuring they are knowledgeable and effective.

- Limited brand recognition: The agency struggles to stand out in a crowded market.

- Rising interest in bundled products: Consumers are increasingly seeking comprehensive solutions, presenting growth opportunities.

- Competitive pricing: Price wars can erode profit margins and affect long-term sustainability.

- Brand recognition can take time to build but is essential for growth. By enhancing training programs and adapting to market demands, the agency can improve its position while navigating competitive threats.

SWOT Example N°5 for an Insurance Agency

Another example to expand your perspective on conducting a SWOT analysis for an insurance agency is presented here. This case highlights the importance of community engagement and potential market risks.

| SWOT | Analysis |

|---|---|

| Strengths | Strong community ties |

| Weaknesses | Lack of online reviews |

| Opportunities | Potential for community events |

| Threats | New regulations impacting operations |

- Strong community ties: The agency has built lasting relationships within the local community, enhancing trust and loyalty.

- Lack of online reviews: A minimal digital footprint can deter potential clients seeking feedback.

- Potential for community events: Engaging with the community through events can boost visibility and client acquisition.

- New regulations: Changes in laws can affect how the agency operates and delivers services.

- Engaging with the community can strengthen your agency’s position. While community ties are a significant strength, it’s crucial to enhance your online presence to attract new clients and mitigate regulatory risks.

SWOT Example N°6 for an Insurance Agency

Here’s another example that provides further insights into conducting a SWOT analysis for an insurance agency. This case emphasizes the role of customer satisfaction and product diversification.

| SWOT | Analysis |

|---|---|

| Strengths | High customer satisfaction ratings |

| Weaknesses | Limited product offerings |

| Opportunities | Growth in e-commerce insurance products |

| Threats | Economic instability affecting clients |

- High customer satisfaction: Consistently positive feedback indicates strong client relationships and service quality.

- Limited product offerings: A narrow range of products may restrict potential market share.

- Growth in e-commerce: The rise of online businesses presents opportunities for tailored insurance solutions.

- Economic instability: Fluctuations in the economy can lead to clients reassessing their insurance needs.

- Client satisfaction is a key driver of retention and referrals. By expanding product offerings and capitalizing on e-commerce trends, the agency can enhance its market position while being mindful of economic threats.

SWOT Example N°7 for an Insurance Agency

Let’s consider another unique angle with this example, which illustrates the dynamics of a SWOT analysis for an insurance agency. This case emphasizes the importance of training and the challenges posed by competition.

| SWOT | Analysis |

|---|---|

| Strengths | Well-trained staff |

| Weaknesses | Inefficient processes |

| Opportunities | Technological advancements in claims processing |

| Threats | Increased competition from startups |

- Well-trained staff: The agency invests in its employees, ensuring they are knowledgeable and capable of providing excellent service.

- Inefficient processes: Existing workflows may lead to delays and decreased client satisfaction.

- Technological advancements: Leveraging new technologies can streamline claims processing and improve client experiences.

- Increased competition: New startups entering the market may offer disruptive services, challenging established agencies.

- Streamlining processes can lead to improved client experiences. By maintaining a focus on staff training while adopting new technologies, the agency can better position itself against emerging competition.

SWOT Example N°8 for an Insurance Agency

Here’s another example to reflect upon when conducting a SWOT analysis for your insurance agency. This case highlights the significance of client diversity and potential market risks.

| SWOT | Analysis |

|---|---|

| Strengths | Diverse clientele |

| Weaknesses | Over-reliance on a single market segment |

| Opportunities | Cross-selling opportunities |

| Threats | Market saturation |

- Diverse clientele: The agency serves a wide range of clients, enhancing its market resilience.

- Over-reliance: Depending heavily on one market segment can expose the agency to risks if that segment declines.

- Cross-selling: Opportunities exist to offer additional products to existing clients, increasing revenue streams.

- Market saturation: High competition in certain segments can limit growth potential.

- Diversifying your client base can help mitigate risks. By focusing on cross-selling and expanding into new segments, the agency can navigate market saturation effectively.

SWOT Example N°9 for an Insurance Agency

In this example, we will explore another unique scenario that provides insights into conducting a SWOT analysis for an insurance agency. This case emphasizes the role of leadership and the impact of external factors.

| SWOT | Analysis |

|---|---|

| Strengths | Strong leadership team |

| Weaknesses | Lack of innovation |

| Opportunities | Expanding into underserved markets |

| Threats | Fluctuating insurance regulations |

- Strong leadership: The agency is guided by a team with a clear vision and effective decision-making capabilities.

- Lack of innovation: The agency may struggle to keep pace with industry changes and new technologies.

- Expanding markets: There are opportunities to tap into demographics that are currently underserved.

- Regulatory fluctuations: Changes in laws can create uncertainty and impact business operations.

- Leadership plays a vital role in fostering innovation. By leveraging strengths in leadership while addressing innovation gaps, the agency can better navigate regulatory threats and capitalize on new market opportunities.

SWOT Example N°10 for an Insurance Agency

Finally, let’s look at one more example to round out our exploration of conducting a SWOT analysis for an insurance agency. This case highlights the importance of client relationships and the challenges of brand perception.

| SWOT | Analysis |

|---|---|

| Strengths | Established client relationships |

| Weaknesses | Inconsistent marketing efforts |

| Opportunities | Increased focus on sustainable insurance products |

| Threats | Public perception of the insurance industry |

- Established relationships: Long-term clients contribute to stable revenue and referrals.

- Inconsistent marketing: Lack of a cohesive marketing strategy may hinder growth.

- Sustainable products: Rising interest in environmentally friendly insurance solutions presents new opportunities.

- Industry perception: Negative public sentiment towards the insurance industry can affect new client acquisition.

- Building trust can counteract negative perceptions. By focusing on strengthening marketing efforts and adapting to the demand for sustainable products, the agency can enhance its reputation and attract new clients.

Wrapping It Up: Your Roadmap to Success

In conclusion, conducting a SWOT analysis is not merely a task to check off; it’s a vital strategy that can transform your insurance agency’s approach to business. By understanding your strengths, weaknesses, opportunities, and threats, you can make informed decisions that lead to sustained growth. So, roll up your sleeves, gather your team, and start your SWOT analysis today!

If you’re looking for a comprehensive resource, check out this business plan template for your Insurance Agency. It provides a structured approach to help you outline your goals and strategies effectively.

Additionally, you may find our articles helpful: learn How to Establish an Insurance Agency? and discover How to Build an Insurance Agency Marketing Plan? for further insights.

Frequently Asked Questions

1. What is a SWOT analysis?

A SWOT analysis is a strategic tool that helps businesses identify their strengths, weaknesses, opportunities, and threats related to their operations.

2. Why is a SWOT analysis essential for insurance agencies?

This analysis aids agencies in understanding their competitive positioning and guides them in making strategic decisions.

3. How often should an insurance agency perform a SWOT analysis?

It is advisable to conduct a SWOT analysis annually or whenever significant market changes occur.

4. What are common strengths for insurance agencies?

Typical strengths include a solid reputation, exceptional customer service, and a diverse range of insurance products.

5. Can a SWOT analysis improve marketing strategies?

Absolutely! It provides insights that can enhance and inform marketing efforts for better outreach.

6. What weaknesses should agencies look for in a SWOT analysis?

Common weaknesses might include limited online visibility, high employee turnover, and gaps in expertise.

7. How can opportunities be identified in a SWOT analysis?

Opportunities can be uncovered through market research, identifying trends in consumer behavior, and analyzing industry shifts.

8. What threats should insurance agencies be aware of?

Threats can include economic downturns, regulatory changes, and increased competition in the market.

9. How can an agency act on its SWOT analysis findings?

Agencies should develop strategic plans based on their findings to maximize strengths and opportunities while addressing weaknesses and threats.

10. What are the initial steps in conducting a SWOT analysis?

Gather your team, define the scope, and begin brainstorming each quadrant of the SWOT analysis to identify key factors.