Why Should You Have a SWOT Analysis for Insurance Brokers?

Have you ever wondered why some insurance brokers thrive while others struggle? It’s not just about luck; it’s about strategy! A SWOT analysis for insurance brokers can be a game-changer in understanding your business landscape. In fact, studies show that businesses that regularly conduct SWOT analyses see a 20% increase in their strategic effectiveness.

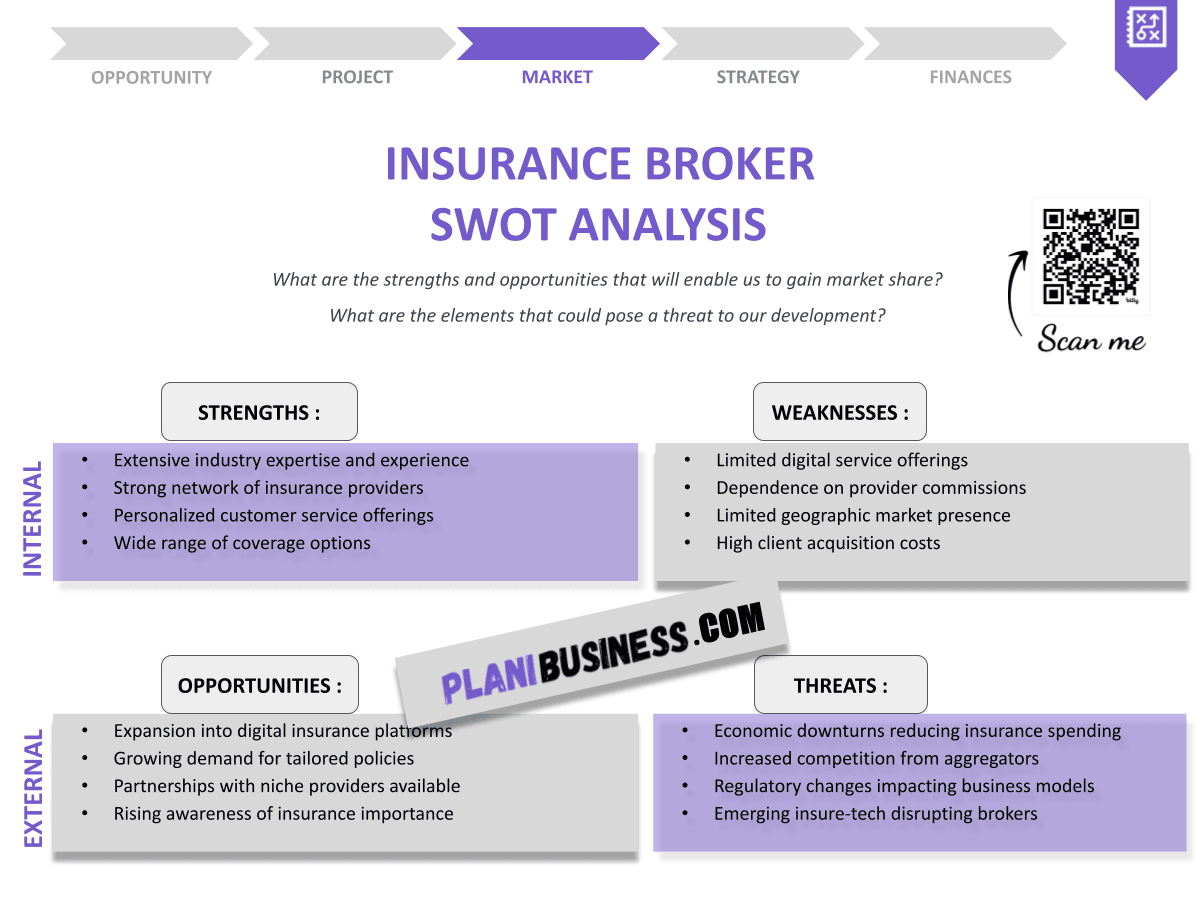

So, what exactly is a SWOT analysis? Simply put, it’s a framework for identifying your business’s Strengths, Weaknesses, Opportunities, and Threats. It helps you pinpoint what you’re doing well and where you can improve, all while keeping an eye on the competition and market trends.

- Understand your business landscape

- Identify areas for improvement

- Leverage strengths effectively

- Recognize market opportunities

- Anticipate potential threats

- Enhance strategic decision-making

- Foster team collaboration

- Increase competitive advantage

- Align your goals with market realities

- Drive business growth and sustainability

How Do You Write a SWOT Analysis for Insurance Brokers?

Creating a SWOT analysis might seem daunting, but it’s pretty straightforward once you break it down. Here’s how to tackle each component:

Strengths

Strengths are the internal attributes that give your insurance brokerage an advantage over competitors.

- Strong Client Relationships: Building rapport with clients can lead to referrals and repeat business.

- Diverse Product Offerings: A wide range of insurance products can cater to various customer needs.

- Experienced Team: A knowledgeable and experienced team can provide superior service.

- Strong Brand Reputation: A well-known brand can instill trust and attract clients.

Weaknesses

Identifying weaknesses is crucial for improvement.

- Limited Marketing Budget: A small budget can restrict your ability to reach new clients.

- Lack of Online Presence: In today’s digital world, not having a robust online presence can be a significant drawback.

- High Employee Turnover: Frequent staff changes can disrupt service and client relationships.

- Limited Geographic Reach: Operating in a small area can limit your client base.

Opportunities

Look for external factors that could benefit your business.

- Growing Insurance Market: The insurance market is expanding, providing more clients.

- Technological Advancements: Adopting new technologies can improve efficiency and client experience.

- Regulatory Changes: New regulations can create opportunities for niche markets.

- Social Media Marketing: Leveraging social media can enhance visibility and engagement.

Threats

Be aware of external challenges that could impact your brokerage.

- Intense Competition: The insurance market is competitive, which can pressure pricing.

- Economic Downturns: Economic challenges can lead to reduced insurance sales.

- Changing Consumer Preferences: Shifts in consumer behavior can affect demand.

- Regulatory Changes: New regulations can impose restrictions or increase costs.

SWOT Example N°1 for Insurance Broker

Here’s a practical example to illustrate a SWOT analysis for an insurance broker:

| SWOT | Analysis |

|---|---|

| Strengths | Established client base and brand loyalty |

| Weaknesses | Limited digital marketing efforts |

| Opportunities | Expansion into new markets |

| Threats | Regulatory changes affecting commission rates |

- Summary Points:

- Strong client relationships lead to loyalty.

- Digital presence needs improvement.

- Market expansion presents new opportunities.

- Regulatory changes could impact earnings.

This example highlights how a strong brand can be both a strength and a potential weakness if not marketed effectively. The opportunity for expansion is significant, but brokers must navigate regulatory changes carefully.

SWOT Example N°2 for Insurance Broker

Another example can provide further insights:

| SWOT | Analysis |

|---|---|

| Strengths | Diverse product offerings |

| Weaknesses | High employee turnover |

| Opportunities | Growing demand for health insurance |

| Threats | Increased competition from online brokers |

- Summary Points:

- Diverse offerings attract varied clients.

- Employee turnover can disrupt service.

- Health insurance demand is on the rise.

- Online brokers present a new challenge.

This SWOT analysis showcases the importance of maintaining employee satisfaction to reduce turnover. The growing demand for health insurance presents a clear opportunity for brokers to capitalize on.

SWOT Example N°3 for Insurance Broker

Continuing with our examples:

| SWOT | Analysis |

|---|---|

| Strengths | Strong community ties |

| Weaknesses | Limited technology use |

| Opportunities | Partnerships with local businesses |

| Threats | Economic downturn affecting client budgets |

- Summary Points:

- Community ties enhance local trust.

- Technology adoption is lacking.

- Local partnerships can boost referrals.

- Economic downturns can reduce sales.

This analysis emphasizes the value of community engagement. While strong ties can be a significant asset, brokers must also invest in technology to remain competitive.

SWOT Example N°4 for Insurance Broker

Next example:

| SWOT | Analysis |

|---|---|

| Strengths | Experienced staff |

| Weaknesses | Inadequate training programs |

| Opportunities | Online training resources |

| Threats | Changing regulations affecting practices |

- Summary Points:

- Experienced staff is a great asset.

- Training programs need improvement.

- Online resources can enhance training.

- Regulations may change how business is conducted.

This analysis points out the importance of continuous training for staff. Experienced employees are invaluable, but they must be kept updated with ongoing education.

SWOT Example N°5 for Insurance Broker

Another insightful example:

| SWOT | Analysis |

|---|---|

| Strengths | Innovative marketing strategies |

| Weaknesses | Lack of customer feedback mechanisms |

| Opportunities | Utilizing social media for engagement |

| Threats | Negative online reviews impacting reputation |

- Summary Points:

- Innovative marketing attracts new clients.

- Customer feedback is currently lacking.

- Social media can enhance interaction.

- Negative reviews pose a threat.

Here, the focus is on marketing innovation. While it’s a strength, brokers need to ensure they’re listening to clients to mitigate the risk of negative feedback.

SWOT Example N°6 for Insurance Broker

Yet another example for clarity:

| SWOT | Analysis |

|---|---|

| Strengths | Personalized customer service |

| Weaknesses | Limited geographic reach |

| Opportunities | Expansion through remote consultations |

| Threats | New market entrants |

- Summary Points:

- Personalized service builds strong relationships.

- Geographic limitations can restrict growth.

- Remote consultations can expand reach.

- Market entrants increase competition.

This example highlights the need for insurance brokers to adapt to changing market dynamics, especially in offering remote services to clients.

SWOT Example N°7 for Insurance Broker

Continuing with another example:

| SWOT | Analysis |

|---|---|

| Strengths | Strong online presence |

| Weaknesses | Underutilized customer relationship management (CRM) |

| Opportunities | Growing trend of online insurance purchases |

| Threats | Cybersecurity risks |

- Summary Points:

- Online presence attracts digital clients.

- CRM tools are not fully utilized.

- Online purchases are on the rise.

- Cybersecurity poses significant risks.

This analysis shows how a robust online presence can be leveraged for growth, while the need for effective CRM utilization is crucial for maintaining client relationships.

SWOT Example N°8 for Insurance Broker

Let’s look at another example:

| SWOT | Analysis |

|---|---|

| Strengths | Comprehensive risk assessment techniques |

| Weaknesses | Slow response times |

| Opportunities | Demand for customized insurance solutions |

| Threats | Increasing regulatory scrutiny |

- Summary Points:

- Risk assessment techniques set brokers apart.

- Response times must be improved.

- Custom solutions meet client needs.

- Regulatory scrutiny may increase compliance costs.

This example highlights how comprehensive risk assessment can be a competitive edge, but brokers must work on improving response times to meet client expectations.

SWOT Example N°9 for Insurance Broker

Let’s examine another example:

| SWOT | Analysis |

|---|---|

| Strengths | Long-standing industry relationships |

| Weaknesses | Limited product knowledge |

| Opportunities | Training programs for staff |

| Threats | Market shifts affecting traditional products |

- Summary Points:

- Industry relationships are valuable assets.

- Product knowledge needs enhancement.

- Training can improve staff capabilities.

- Market shifts may require product adjustments.

This analysis emphasizes the importance of product knowledge in the insurance industry and how training can help brokers stay relevant.

SWOT Example N°10 for Insurance Broker

Final example to round things out:

| SWOT | Analysis |

|---|---|

| Strengths | Strong community engagement |

| Weaknesses | Inefficient internal processes |

| Opportunities | Community events for visibility |

| Threats | Economic changes affecting client budgets |

- Summary Points:

- Community engagement fosters trust.

- Internal processes need streamlining.

- Events can enhance visibility.

- Economic changes impact client spending.

This SWOT analysis showcases how community engagement can be a broker's strength while also pointing out the need for efficient processes to manage growth.

Conclusion

In summary, a SWOT analysis is an essential tool for insurance brokers to understand their position in the market. By identifying strengths, weaknesses, opportunities, and threats, you can develop strategies that lead to growth and success. If you haven’t done one for your brokerage yet, now is the time to start! For a solid foundation, consider using a business plan template for insurance brokers that can guide you through the process.

Additionally, check out our articles on How to Kickstart an Insurance Broker Business? and How to Start an Insurance Broker Marketing Plan? With Example for more insights and actionable strategies to enhance your brokerage.

FAQ

What is a SWOT analysis?

A SWOT analysis is a strategic planning tool used to identify the Strengths, Weaknesses, Opportunities, and Threats related to a business.

Why is a SWOT analysis important for insurance brokers?

It helps insurance brokers assess their competitive position and make informed decisions to improve their services.

How often should a SWOT analysis be conducted?

It’s advisable to conduct a SWOT analysis at least once a year or whenever significant changes occur in the market.

Can a SWOT analysis improve marketing strategies?

Yes! By understanding your strengths and weaknesses, you can refine your marketing strategies to better target potential clients.

What are common weaknesses identified in insurance brokers?

Common weaknesses include a limited marketing budget, high employee turnover, and insufficient online presence.

How can opportunities from a SWOT analysis be leveraged?

Identify the most promising opportunities and develop specific strategies to capitalize on them.

What threats should insurance brokers be aware of?

Threats include economic downturns, regulatory changes, and increasing competition from other brokers.

How can weaknesses identified in a SWOT analysis be improved?

Focus on enhancing training, marketing efforts, and improving internal processes to address identified weaknesses.

Is it beneficial to involve my team in the SWOT analysis?

Absolutely! Involving your team can provide diverse perspectives and foster a sense of ownership in the strategic planning process.

What should be done after completing a SWOT analysis?

Use the insights gained to create an actionable strategic plan that addresses your findings and sets clear goals for your brokerage.