Why Should You Have a SWOT Analysis for Wealth Management?

Are you a wealth management advisor looking to sharpen your strategic edge? You’re in the right place! A SWOT analysis can be the game-changer you need to enhance your practice and better serve your clients. Did you know that over 70% of financial advisors who regularly conduct SWOT analyses report increased client satisfaction and retention? That’s the kind of impact we’re talking about!

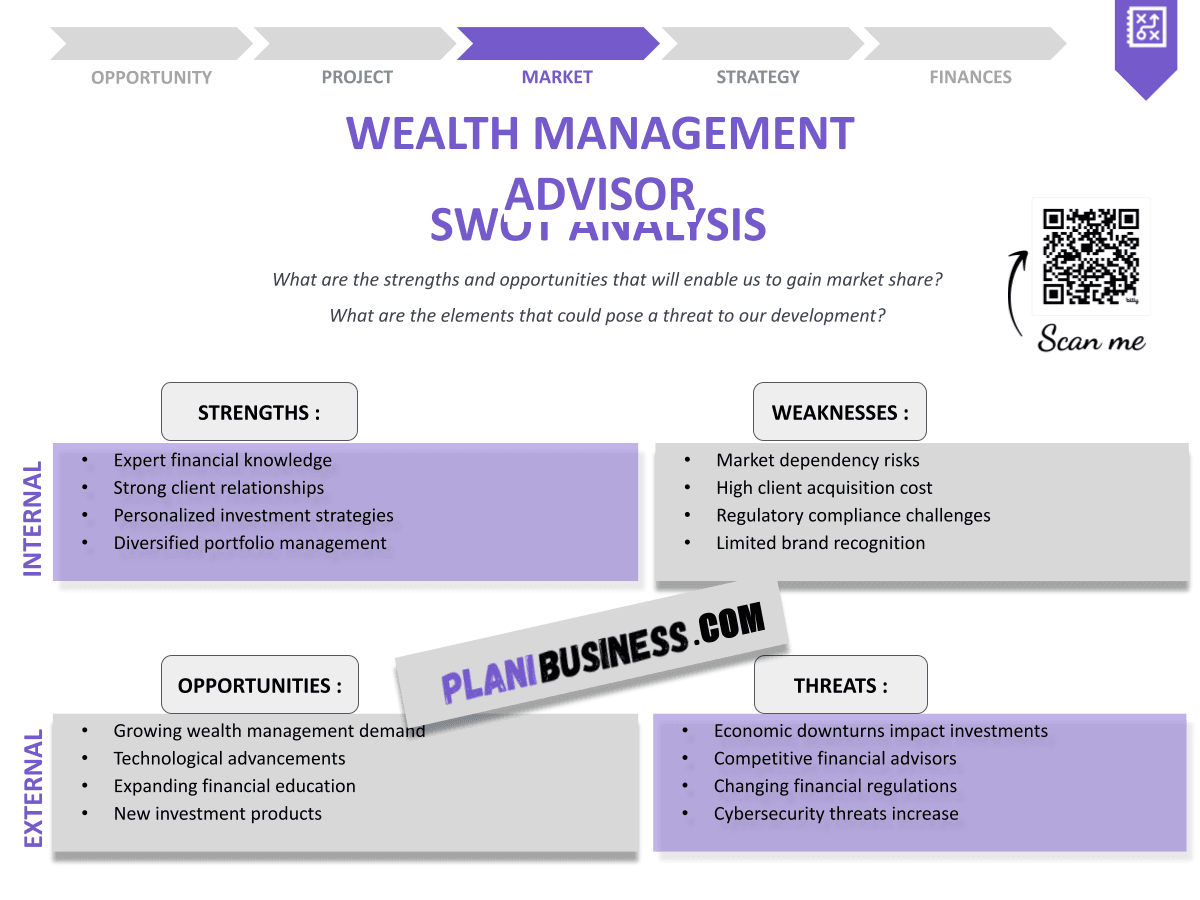

A SWOT analysis—standing for Strengths, Weaknesses, Opportunities, and Threats—helps you identify your firm’s unique position in the marketplace and plan effectively for the future. By understanding your strengths, you can leverage them to attract and retain clients. Recognizing your weaknesses allows you to address gaps in your service delivery, ensuring a more comprehensive client experience. Identifying opportunities helps you capitalize on market trends, while being aware of threats keeps you prepared for potential challenges.

Here’s a sneak peek of what you’ll learn:

- Understanding the importance of SWOT analysis in wealth management

- How to conduct a SWOT analysis step-by-step

- Real-world examples of successful SWOT analyses

- Key takeaways for your own advisory practice

How Do You Write a SWOT Analysis for Wealth Management?

Creating a SWOT analysis isn’t rocket science, but it does require some thought. Let’s break it down into manageable parts.

Strengths

Strengths are what set your firm apart from the competition. Think about your unique offerings or team expertise. Start by identifying your core competencies and how they benefit clients. Discuss the qualifications and experience of your team, highlighting any technological advantages or innovative services you provide. Additionally, consider your client relationships and retention rates as potential strengths that can enhance your reputation.

Weaknesses

It’s tough, but recognizing weaknesses is essential for growth. Be honest about areas needing improvement. Discuss any gaps in your service offerings that may leave clients wanting more. Consider feedback from clients and team members to identify issues that may not be immediately apparent. Finally, think about any resource constraints that impact your service delivery.

Opportunities

Opportunities are everywhere if you know where to look! Explore emerging market trends and technologies that can benefit your practice. Discuss potential partnerships or collaborations that could enhance your offerings. Consider demographic shifts and their implications for your target market. Lastly, identify areas for service expansion or new client acquisition that can provide a competitive advantage.

Threats

Threats can come from various sources, so it’s vital to stay vigilant. Consider regulatory changes that could impact your business and discuss competitive pressures from other firms. Identify economic factors that may pose risks to your clients’ investments and be aware of potential cybersecurity threats that could compromise your firm’s integrity.

SWOT Example N°1 for Wealth Management

In this section, we’ll look at a real-world example of a wealth management advisor’s SWOT analysis. This case highlights how a firm can assess its position and strategically plan for future growth.

| SWOT | Analysis |

|---|---|

| Strengths | Established brand with loyal clients |

| Weaknesses | Limited online presence |

| Opportunities | Growing demand for digital financial advice |

| Threats | Increased competition from robo-advisors |

- Strong client loyalty

- Brand recognition

- Need for digital transition

- Competition from tech-driven solutions

This example illustrates how a firm can leverage its established brand while addressing its weaknesses in digital presence. Transitioning to digital platforms can enhance client engagement and broaden the firm's reach in the ever-evolving wealth management landscape.

SWOT Example N°2 for Wealth Management

Here’s another practical example to consider, showcasing a different approach to a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Highly skilled financial analysts |

| Weaknesses | High turnover rate |

| Opportunities | Expansion into underserved markets |

| Threats | Economic downturn affecting client investments |

- Expertise in financial analysis

- Challenges in team stability

- Potential for market expansion

- Risks from economic fluctuations

This example shows how a firm's expertise can be a strength while also acknowledging the internal challenge of turnover. Focusing on retention strategies can mitigate threats and ensure that the firm maintains a stable and knowledgeable team to serve its clients effectively.

SWOT Example N°3 for Wealth Management

Let’s explore another case study of a wealth management advisor’s SWOT analysis to understand different strategies and approaches.

| SWOT | Analysis |

|---|---|

| Strengths | Personalized client service |

| Weaknesses | Inadequate marketing strategies |

| Opportunities | Increasing interest in sustainable investing |

| Threats | Regulatory scrutiny |

- Personalized service as a competitive edge

- Need for marketing overhaul

- Trend towards sustainable investments

- Potential regulatory challenges

This example emphasizes the importance of personal touch in client relationships while recognizing the need for better marketing. Adapting to sustainable investing trends can open new doors for growth and attract a broader client base concerned with ethical investments.

SWOT Example N°4 for Wealth Management

Next up, let’s analyze this scenario to uncover additional insights into a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Strong community ties |

| Weaknesses | Limited product range |

| Opportunities | Growing local economy |

| Threats | Market volatility |

- Community engagement as a strength

- Limited offerings may hinder growth

- Economic growth presents new opportunities

- Market risks require careful navigation

The community connection can be a huge asset, but diversification of offerings is crucial. Keeping an eye on market conditions can help mitigate threats and ensure that the firm remains adaptable in a fluctuating economic environment.

SWOT Example N°5 for Wealth Management

Here’s another insightful example to explore, providing further context on a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Innovative financial products |

| Weaknesses | Lack of brand awareness |

| Opportunities | Rise in remote financial services |

| Threats | Changes in consumer behavior |

- Innovation as a differentiator

- Need for increased visibility

- Remote services on the rise

- Adapting to shifting consumer preferences

Innovation can be a great strength, but without brand awareness, it may go unnoticed. Adapting to consumer behavior is key in today’s market, and leveraging remote services can enhance client engagement and accessibility.

SWOT Example N°6 for Wealth Management

Let’s analyze another practical scenario to gain more insights into a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Experienced advisory team |

| Weaknesses | Outdated technology |

| Opportunities | Growth in niche markets |

| Threats | Cybersecurity risks |

- Team experience as a valuable asset

- Technology updates are necessary

- Niche market growth potential

- Cybersecurity must be prioritized

An experienced team is invaluable, but outdated tech can hinder operations. Investing in security measures is essential for client trust, and focusing on niche markets can help the firm stand out in a crowded landscape.

SWOT Example N°7 for Wealth Management

Here’s another example worth exploring, showcasing additional strategies in a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Strong referral network |

| Weaknesses | Inconsistent service delivery |

| Opportunities | Increasing focus on retirement planning |

| Threats | Legislative changes |

- Referrals as a marketing tool

- Service consistency needs improvement

- Retirement planning demand is rising

- Legislative risks are real

Referrals can drive business growth, but service consistency is crucial. Staying informed about legislative changes will help navigate potential threats and ensure compliance while addressing the growing demand for retirement planning services.

SWOT Example N°8 for Wealth Management

Let’s take a look at this example to further understand the dynamics of a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Comprehensive financial planning |

| Weaknesses | Limited geographic reach |

| Opportunities | Online consultation options |

| Threats | Competition from larger firms |

- Holistic planning as a strength

- Geographic limitations can restrict growth

- Online options open new doors

- Competing with larger firms is challenging

Comprehensive planning is a big plus, but reaching a wider audience is necessary. Online consultations can help level the playing field against larger firms, allowing the advisor to expand their client base effectively.

SWOT Example N°9 for Wealth Management

Here’s another insightful analysis to consider, providing further context on a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Diverse service offerings |

| Weaknesses | High operational costs |

| Opportunities | Demand for financial literacy programs |

| Threats | Economic downturn impacts |

- Diversity in services is beneficial

- Costs need to be managed

- Financial literacy is a growing need

- Economic conditions can pose risks

Diverse offerings attract clients, but managing costs is essential for sustainability. Addressing financial literacy can create new engagement opportunities and help clients navigate potential economic challenges effectively.

SWOT Example N°10 for Wealth Management

Finally, let’s explore this last example to wrap up our insights into a wealth management advisor’s SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Customizable investment strategies |

| Weaknesses | Limited client feedback mechanisms |

| Opportunities | Rise of socially responsible investing |

| Threats | Rapid market changes |

- Custom strategies meet client needs

- Feedback mechanisms need improvement

- Socially responsible investing is trending

- Market changes require agility

Custom strategies can enhance client satisfaction, but feedback is vital for continuous improvement. Staying ahead of market trends, particularly in socially responsible investing, is crucial for remaining relevant and competitive in the evolving wealth management landscape.

Wrapping It Up: Your Wealth Management SWOT Analysis

In conclusion, conducting a SWOT analysis for your wealth management advisor practice is not just a good idea—it’s essential for staying competitive. By understanding your strengths, weaknesses, opportunities, and threats, you can make informed decisions that will benefit your business and your clients. Don’t hesitate to explore additional resources that can aid in your strategic planning. For a comprehensive guide, check out this business plan template for Wealth Management Advisors that can help you outline your goals and strategies effectively.

Additionally, if you’re looking to dive deeper into the field, consider reading our articles on How to Set Up a Wealth Management Advisor Business and How to Plan a Wealth Management Advisor Marketing Strategy? With Example. These resources will provide you with valuable insights to enhance your practice.

Frequently Asked Questions about Wealth Management Advisor SWOT Analysis

1. What is a SWOT analysis in wealth management?

A SWOT analysis is a strategic tool used by wealth management advisors to identify their Strengths, Weaknesses, Opportunities, and Threats in the financial advisory landscape.

2. Why is a SWOT analysis important?

It offers insights that can help advisors make informed decisions, improve their services, and adapt to changes in the market.

3. How often should I conduct a SWOT analysis?

It’s advisable to perform a SWOT analysis annually or whenever significant changes occur in your practice or the market environment.

4. Can a SWOT analysis help with client retention?

Definitely! Understanding your strengths and addressing your weaknesses can significantly enhance client satisfaction and retention.

5. What if I have trouble identifying my weaknesses?

Consider seeking feedback from clients and colleagues, or consult with an external expert for a fresh perspective on your wealth management practices.

6. How can I leverage opportunities identified in my SWOT analysis?

Develop targeted strategies that align with your strengths to capitalize on the identified opportunities.

7. What threats should I be aware of?

Stay informed about regulatory changes, competitive pressures, and economic factors that could impact your practice and your clients.

8. How do I implement my SWOT analysis findings?

Create an actionable plan that addresses the identified weaknesses and threats while leveraging your strengths and opportunities.

9. Is a SWOT analysis useful for new advisors?

Absolutely! It helps new advisors understand their position in the market and develop effective strategies for growth.

10. Can technology impact my SWOT analysis?

Indeed! Technology can enhance your strengths and opportunities, but it may also introduce new threats that you need to consider.