Why Should You Have a SWOT Analysis for House Flipping?

Are you thinking about diving into the house flipping business? You’re not alone! In fact, the house flipping market has exploded over the last decade, with thousands of investors seeking to turn a profit. But did you know that approximately 80% of new flippers fail within the first year? That’s a staggering number! This is where a SWOT analysis comes into play. It’s a powerful tool that can help you identify your strengths, weaknesses, opportunities, and threats, giving you a clear roadmap to success in the competitive world of real estate investment.

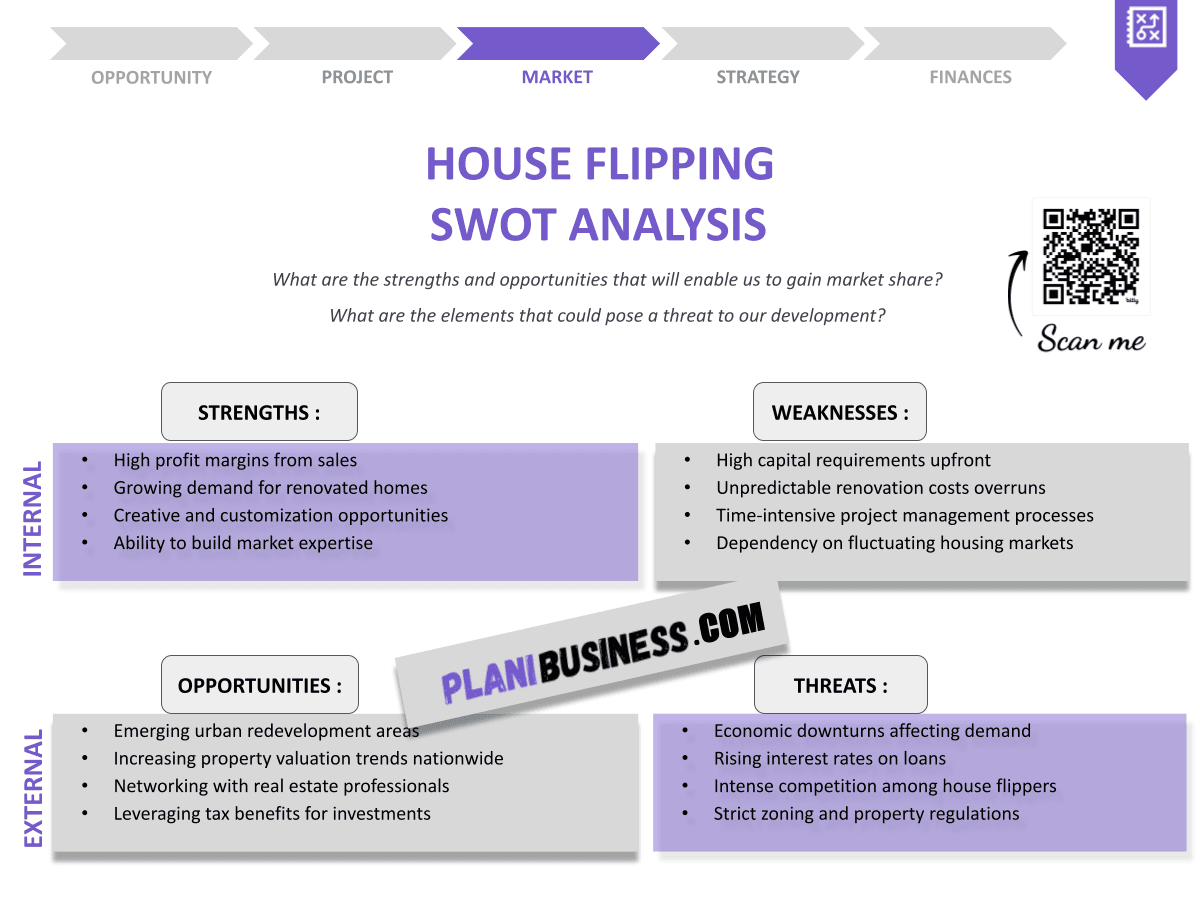

A SWOT analysis is a strategic planning technique used to identify and evaluate the internal and external factors that can impact a project or business. By understanding these elements, you can create a more informed strategy for your house flipping endeavors.

- Importance of SWOT in house flipping.

- Steps to conduct a SWOT analysis.

- Strengths to leverage in flipping.

- Common weaknesses to address.

- Opportunities in the current market.

- Threats facing new flippers.

- Detailed examples of SWOT analyses.

- How to use insights for strategic planning.

- Real-world application of SWOT in flips.

- Final thoughts and next steps for readers.

How Do You Write a SWOT Analysis for House Flipping?

Writing a SWOT analysis for house flipping involves a systematic approach to understanding your business environment. You’ll want to gather data on your current position, market conditions, and personal capabilities. Here’s how to break it down:

Strengths

One of the primary strengths in house flipping can be your financial stability. If you have access to funds or financing options, that’s a significant advantage.

Your knowledge of the local real estate market can also be a key strength. Understanding neighborhoods, pricing trends, and buyer preferences can lead to better investment decisions.

If you have a solid network of contractors and real estate professionals, that can streamline your flipping process and reduce costs.

Finally, possessing strong negotiation skills can help you secure properties at lower prices, increasing your potential profit margins.

Weaknesses

A common weakness in house flipping is lack of experience. New flippers often underestimate the time and effort required for renovations.

Financial mismanagement can be another pitfall. Going over budget on renovations can eat into your profits.

Poor market research can lead to buying properties in declining neighborhoods, which can significantly reduce your potential returns.

Lastly, emotional decision-making can cloud judgment, leading to choices that aren’t backed by data or sound strategy.

Opportunities

The current housing market presents many opportunities, especially for distressed properties that can be bought below market value.

Rising demand for rental properties offers the chance to flip homes and then rent them out for passive income.

Government grants and incentives for home renovations can reduce costs and increase profitability.

Emerging trends, like eco-friendly homes, can create unique selling points for your flips.

Threats

Economic downturns can pose a significant threat to house flipping, as property values may decline.

Increased competition from other investors can drive prices up, reducing potential profit margins.

Changing regulations and housing policies can create hurdles that are challenging to navigate.

Market saturation can also lead to longer selling times and reduced profitability.

SWOT Example N°1 for House Flipping

Let’s dive into a practical example of a SWOT analysis for house flipping. In this case, we’ll look at a flipper who has a solid financial background and strong market knowledge.

| SWOT | Analysis |

|---|---|

| Strengths | Financial stability, market knowledge |

| Weaknesses | Lack of experience, emotional decisions |

| Opportunities | Distressed properties, rental demand |

| Threats | Economic downturns, competition |

- Financial stability as a strength.

- Lack of experience as a weakness.

- Distressed properties as an opportunity.

- Economic downturns as a threat.

In this example, the flipper's financial stability gives them a competitive edge, but their inexperience could lead to costly mistakes. Identifying distressed properties in a recovering market can present a great opportunity for profit.

SWOT Example N°2 for House Flipping

Here’s another example to illustrate how a SWOT analysis can guide your strategy in house flipping. This time, we’ll focus on a flipper who is leveraging a strong contractor network.

| SWOT | Analysis |

|---|---|

| Strengths | Strong negotiation skills, contractor network |

| Weaknesses | Overestimating renovation costs |

| Opportunities | Government grants for renovations |

| Threats | Changing housing regulations |

- Strong negotiation skills as a strength.

- Overestimating renovation costs as a weakness.

- Government grants as an opportunity.

- Changing regulations as a threat.

In this case, leveraging strong negotiation skills can secure better deals. However, underestimating renovation costs can lead to budget overruns, making it critical to research thoroughly.

SWOT Example N°3 for House Flipping

This example focuses on a flipper targeting a specific market segment, specifically fixer-uppers in suburban neighborhoods.

| SWOT | Analysis |

|---|---|

| Strengths | Niche market expertise, existing buyer network |

| Weaknesses | Limited marketing resources |

| Opportunities | Increased demand for affordable housing |

| Threats | Market saturation |

- Niche market expertise as a strength.

- Limited marketing resources as a weakness.

- Increased demand for affordable housing as an opportunity.

- Market saturation as a threat.

In this case, the flipper’s expertise in a niche market allows them to cater to specific buyer needs effectively. However, their limited marketing resources might hinder their ability to reach potential buyers, especially in a competitive environment.

SWOT Example N°4 for House Flipping

Now, let’s analyze a flipper who focuses on urban properties, capitalizing on the growing demand in city areas.

| SWOT | Analysis |

|---|---|

| Strengths | Urban property access, renovation experience |

| Weaknesses | Higher initial investment costs |

| Opportunities | Urban revitalization projects |

| Threats | Economic fluctuations |

- Access to urban properties as a strength.

- Higher investment costs as a weakness.

- Urban revitalization as an opportunity.

- Economic fluctuations as a threat.

This flipper’s access to urban properties positions them well in a competitive market, but the high initial investment costs can be a barrier. Urban revitalization projects present lucrative opportunities if timed correctly.

SWOT Example N°5 for House Flipping

In this example, we will analyze a flipper who focuses on suburban homes, catering to families looking for affordable housing options.

| SWOT | Analysis |

|---|---|

| Strengths | Suburban demand, strong community ties |

| Weaknesses | Limited renovation skills |

| Opportunities | Family-oriented market growth |

| Threats | Rising property taxes |

- Suburban demand as a strength.

- Limited renovation skills as a weakness.

- Family market growth as an opportunity.

- Rising property taxes as a threat.

With a strong demand for suburban homes, this flipper can capitalize on family-oriented growth. However, their limited renovation skills may require hiring more help, increasing costs and affecting profit margins.

SWOT Example N°6 for House Flipping

This example examines a flipper targeting luxury homes in affluent neighborhoods, focusing on high-profit margins.

| SWOT | Analysis |

|---|---|

| Strengths | High-profit margins, established brand |

| Weaknesses | Smaller buyer pool |

| Opportunities | Luxury market growth |

| Threats | Economic downturns |

- High-profit margins as a strength.

- Smaller buyer pool as a weakness.

- Growth in luxury market as an opportunity.

- Economic downturns as a threat.

While targeting luxury homes can yield high profits, the smaller buyer pool presents challenges. However, as the luxury market grows, there’s potential for significant returns if the right strategies are implemented.

SWOT Example N°7 for House Flipping

This example looks at a flipper who utilizes innovative technology to enhance their house flipping strategy.

| SWOT | Analysis |

|---|---|

| Strengths | Use of technology, market adaptability |

| Weaknesses | High tech costs |

| Opportunities | Tech-savvy buyer market |

| Threats | Rapid tech changes |

- Technology use as a strength.

- High tech costs as a weakness.

- Tech-savvy market as an opportunity.

- Rapid changes as a threat.

This flipper’s use of technology to enhance listings can attract buyers. However, the high costs of tech tools can be a burden, and staying current with trends is essential to maintain a competitive edge in the real estate market.

SWOT Example N°8 for House Flipping

Let’s explore a flipper focused on historical homes, appealing to buyers interested in unique properties.

| SWOT | Analysis |

|---|---|

| Strengths | Unique property appeal, historical knowledge |

| Weaknesses | Higher renovation standards |

| Opportunities | Niche market interest |

| Threats | Regulatory hurdles |

- Unique appeal of historical homes as a strength.

- Higher renovation standards as a weakness.

- Niche market interest as an opportunity.

- Regulatory hurdles as a threat.

This flipper’s expertise in historical homes gives them a unique market advantage. However, the higher renovation standards can be challenging to meet due to regulations, making thorough planning essential for success in the house flipping business.

SWOT Example N°9 for House Flipping

In this example, we will analyze a flipper who focuses on fixer-uppers, identifying potential in properties that require significant renovations.

| SWOT | Analysis |

|---|---|

| Strengths | Ability to see potential, lower purchase costs |

| Weaknesses | Time-consuming renovations |

| Opportunities | Growing DIY culture |

| Threats | Unforeseen repair costs |

- Ability to see potential as a strength.

- Time-consuming renovations as a weakness.

- Growing DIY culture as an opportunity.

- Unforeseen costs as a threat.

This flipper’s knack for identifying potential in fixer-uppers can lead to great deals. However, the time and unforeseen costs of renovations can eat into profits, making thorough planning and budgeting essential for success.

SWOT Example N°10 for House Flipping

Lastly, let’s look at a flipper targeting vacation rentals, aiming to capitalize on seasonal tourism.

| SWOT | Analysis |

|---|---|

| Strengths | High rental income potential, tourist demand |

| Weaknesses | Seasonal fluctuations |

| Opportunities | Increasing travel trends |

| Threats | Local regulations on rentals |

- High rental income as a strength.

- Seasonal fluctuations as a weakness.

- Increasing travel trends as an opportunity.

- Local regulations as a threat.

This flipper’s focus on vacation rentals can yield high returns, but seasonal demand can lead to income fluctuations. Staying informed about local regulations is crucial to ensure compliance and maximize profits in the house flipping market.

Conclusion

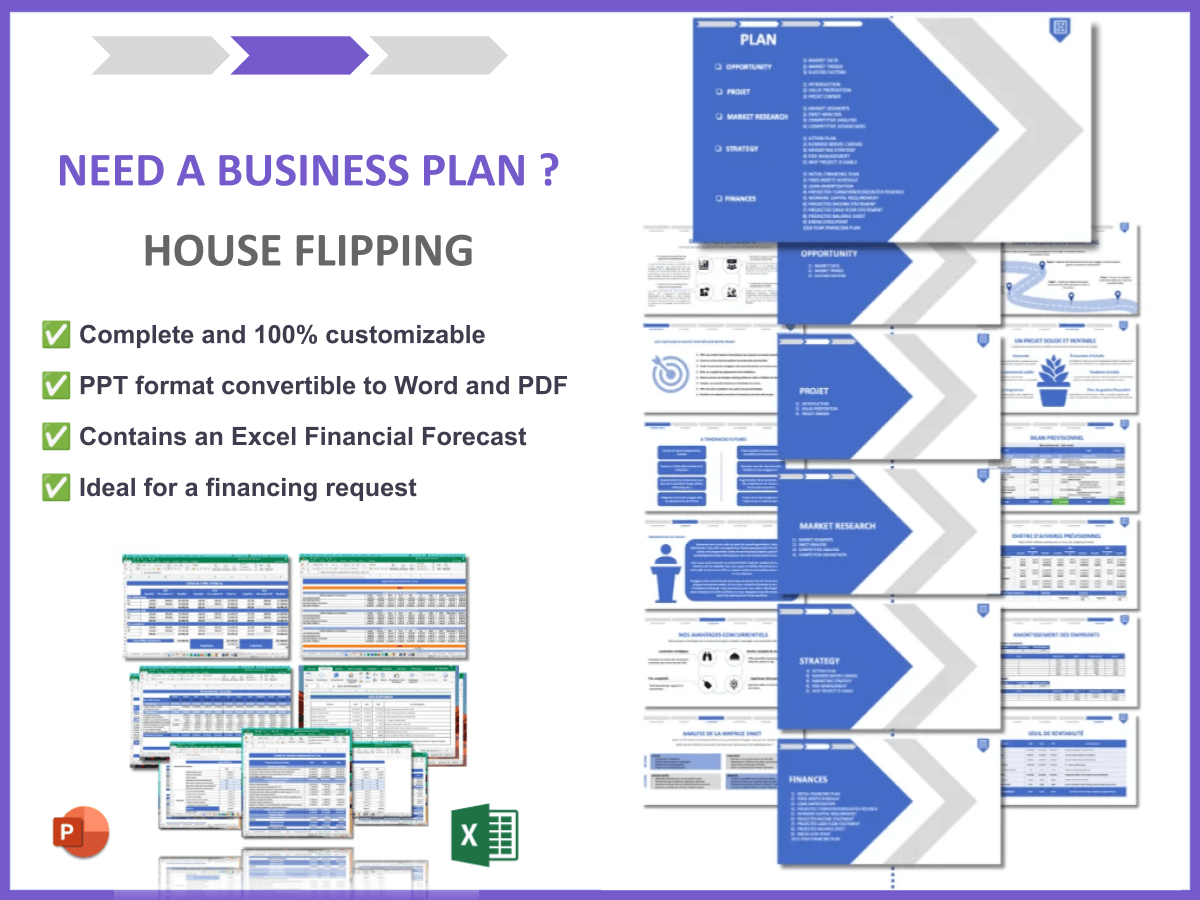

In summary, conducting a SWOT analysis for house flipping is an essential step in strategizing your approach to this lucrative business. By identifying your strengths, weaknesses, opportunities, and threats, you can make informed decisions that lead to successful investments. Whether you’re just starting or looking to refine your strategy, a SWOT analysis can provide clarity and direction. If you want to take your house flipping journey further, consider checking out this business plan template for House Flipping that can help you structure your endeavors effectively.

Additionally, you may find these articles helpful: learn more about How to Develop a House Flipping Business? and explore our guide on How to Build a House Flipping Marketing Plan? With Example. These resources can provide you with valuable insights and strategies to enhance your house flipping success.

FAQ

1. What is a SWOT analysis in house flipping?

A SWOT analysis is a strategic tool that helps identify the strengths, weaknesses, opportunities, and threats related to house flipping, guiding investors in making informed decisions.

2. Why is conducting a SWOT analysis important for real estate investors?

It allows investors to understand their position in the market, assess risks, and develop strategies that maximize profits while minimizing potential losses.

3. How can I identify my strengths in house flipping?

Assess your financial resources, market knowledge, and skills in negotiation to identify your unique advantages in the real estate market.

4. What are common weaknesses in house flipping?

Common weaknesses include lack of experience, poor financial management, and insufficient market research, which can lead to costly mistakes.

5. What opportunities should I be aware of in the housing market?

Look for distressed properties, rising demand for rentals, and available government incentives for renovations that can enhance profitability.

6. How can I mitigate threats in the house flipping business?

Stay updated on market trends, regulations, and competition to proactively address potential threats to your investments.

7. Can a SWOT analysis assist in securing financing?

Yes, a well-prepared SWOT analysis demonstrates to lenders that you have a comprehensive plan, increasing your chances of obtaining financing.

8. How often should I perform a SWOT analysis?

It is advisable to conduct a SWOT analysis at the beginning of each new project or when entering new markets to reassess your strategy.

9. What tools can help me conduct a SWOT analysis?

You can use spreadsheets, SWOT analysis templates, or business planning software to organize your findings and create a strategic plan.

10. How can I apply insights from my SWOT analysis?

Utilize the insights to formulate a strategic plan, emphasizing your strengths and opportunities while addressing any identified weaknesses and threats.