Are you thinking about starting a microlending business? You’re not alone! Over the past decade, the microlending sector has exploded, helping countless entrepreneurs access the funds they need to kickstart their dreams. Microlending refers to providing small loans to individuals or businesses that lack access to traditional banking services. It’s a powerful tool for financial inclusion, enabling people to invest in their futures.

In this article, we’ll explore:

- The fundamental principles of microlending

- How to develop a business model

- Market research techniques

- Funding options available

- Legal considerations

- Marketing strategies to attract borrowers

1. What is Microlending and How to Start a Microlending Business?

To kick things off, let’s dive deeper into the concept of microlending. At its core, it’s all about providing small amounts of money to those who need it the most. Often, these are individuals or small businesses in developing regions that don’t have access to traditional banking systems. The beauty of microlending is that it empowers people to start or grow their businesses, ultimately improving their financial situation and contributing to economic growth.

Here are some key points to consider:

- Empowerment: Microlending allows individuals to take control of their financial futures.

- Community Impact: By supporting local entrepreneurs, you contribute to community development.

- Financial Inclusion: Microlending bridges the gap between the unbanked and traditional financial services.

Understanding these principles is vital as you embark on your journey to start a microlending business.

2. Develop Your Business Model for How to Start a Microlending Business

Creating a business model is crucial for your microlending venture. You need to outline how your operation will work, and this involves several key components:

- Target Market: Who are your borrowers? Are they women entrepreneurs, small business owners, or farmers? Knowing your audience will guide your loan offerings.

- Types of Loans: Will you offer fixed loans, revolving credit, or specific-purpose loans? Each type serves different needs.

- Interest Rates: Determine a fair interest rate that covers your costs while remaining affordable for borrowers.

It’s essential to have a clear vision to guide your operations. A well-defined business model can help you attract investors and customers alike. Consider using a table to compare different aspects of your business model:

| Aspect | Option A | Option B |

|---|---|---|

| Target Market | Women entrepreneurs | Small local businesses |

| Loan Type | Fixed loans | Revolving credit |

| Interest Rate | 5% | 6% |

By laying out these components, you can better visualize your microlending business model and make informed decisions moving forward.

3. Research the Market and Assess Your Competitors for How to Start a Microlending Business

Understanding the market is key to your success in the microlending space. You’ll want to identify your competitors and analyze their strengths and weaknesses. Start by:

- Identifying Local Microlending Organizations: Look into existing businesses in your area that provide similar services.

- Assessing Their Offerings: What types of loans do they provide? What are their interest rates and repayment terms?

- Determining Gaps in the Market: Is there a niche that’s currently underserved? For example, maybe there’s a demand for loans specifically for women entrepreneurs or sustainable businesses.

Gathering this information will help you position your microlending business effectively and identify what makes you unique. A competitive analysis can be structured in a table for clarity:

| Competitor | Loan Types | Interest Rates | Target Market |

|---|---|---|---|

| ABC Microfinance | Fixed loans | 7% | Small businesses |

| Women’s Empowerment Loans | Revolving credit | 5% | Women entrepreneurs |

| Green Ventures | Sustainable project loans | 6% | Eco-friendly businesses |

This competitive landscape will inform your strategy and help you carve out your niche in the microlending market.

4. Choose a Name for Your Microlending Business

Your business name is your first impression, so it’s important to make it count. A strong name should reflect your mission and resonate with your target audience. Here are some tips to help you brainstorm:

- Keep it Short and Simple: Names that are easy to remember tend to stick.

- Ensure it’s Easy to Spell and Pronounce: You want potential clients to easily find you online.

- Check Domain Availability: If you plan to create a website, make sure the domain name is available.

Spend time brainstorming names that resonate with your target audience. Consider creating a shortlist and testing it out with friends or potential customers to see what resonates. Here’s a simple format to evaluate your options:

| Name Idea | Memorability (1-5) | Availability (Yes/No) |

|---|---|---|

| Empower Loans | 5 | Yes |

| Community Microfinance | 4 | No |

| Future Funders | 5 | Yes |

This exercise can help you choose a name that not only sounds good but also represents your microlending business effectively.

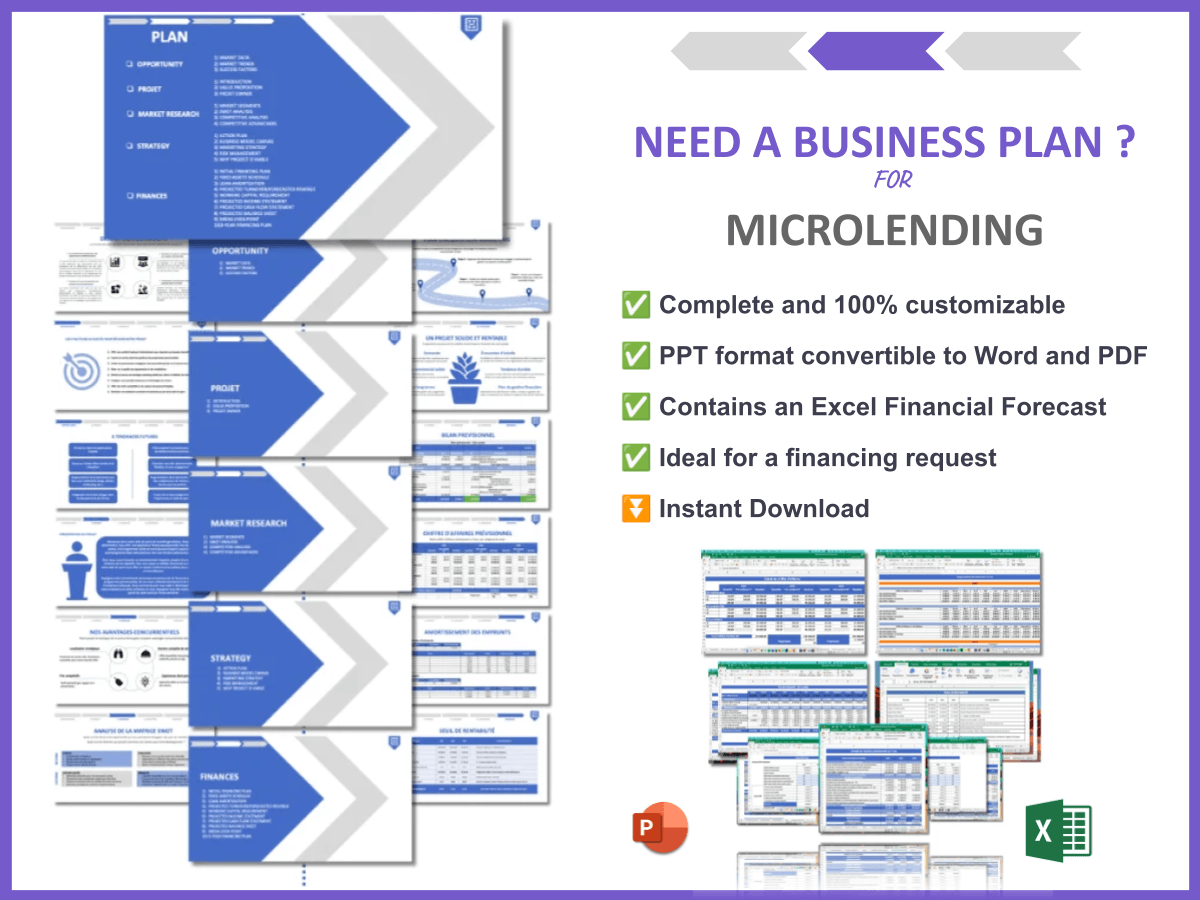

5. Create a Detailed Business Plan for How to Start a Microlending Business

A solid business plan is essential for your microlending venture. It acts as a roadmap, guiding you through the initial stages and beyond. Your business plan should include the following key components:

- Executive Summary: A brief overview of your business, including your mission and objectives.

- Market Analysis: Insights into your target market and competitive landscape.

- Operational Plan: Details on how your microlending business will function on a day-to-day basis.

- Marketing Strategy: How you plan to attract and retain customers.

- Financial Projections: Estimated income, expenses, and profitability over the next few years.

To make the process easier, I recommend checking out this business plan template for Microlending. It’s super detailed and can save you a ton of time! Here’s a quick breakdown of what each section should contain:

| Section | Details |

|---|---|

| Executive Summary | Summarize your mission and vision. |

| Market Analysis | Analyze your target audience and competitors. |

| Operational Plan | Outline your day-to-day operations. |

| Marketing Strategy | Describe how you’ll reach your customers. |

| Financial Projections | Provide detailed financial forecasts. |

Having a comprehensive business plan will not only help you stay organized but also make it easier to secure funding from potential investors.

6. Decide on the Legal Structure for Your Microlending Business

Choosing the right legal structure for your microlending business is a crucial decision. This choice will impact your taxes, liability, and how you can raise funds. Here are some common options:

- Sole Proprietorship: This is the simplest structure, where you alone own the business. However, you are personally liable for any debts.

- Limited Liability Company (LLC): This structure protects your personal assets from business liabilities while providing flexibility in management.

- Corporation: A more complex structure that can attract investors and limit personal liability, but involves more regulatory requirements.

It’s essential to weigh the pros and cons of each structure. Here’s a quick comparison to help you decide:

| Structure | Pros | Cons |

|---|---|---|

| Sole Proprietorship | Easy to set up | Unlimited personal liability |

| LLC | Limited liability protection | More paperwork and fees |

| Corporation | Ability to raise capital | Complex structure and regulations |

Consulting with a legal expert can provide valuable insights and help you choose the best structure for your microlending business.

7. Register Your Business to Make Your Microlending Business Official

Once you have your structure and funding in place, it’s time to make your microlending business official. This process involves several important steps:

- Register Your Business Name: Choose a unique name that reflects your mission and register it with the appropriate state agency.

- File Necessary Paperwork: Depending on your business structure, you may need to file articles of incorporation or organization.

- Obtain a Federal EIN: This Employer Identification Number is crucial for tax purposes and is required for most businesses.

Completing these steps will not only legitimize your microlending operation but also instill confidence in your potential borrowers and investors. Here’s a simple checklist to ensure you cover all bases:

- Choose and register your business name.

- File the necessary incorporation paperwork.

- Obtain your federal EIN.

- Check for local registration requirements.

Taking the time to properly register your business will set a strong foundation for future growth and success.

8. Obtain Necessary Tax Identification Numbers, Licenses, and Permits for Your Microlending Business

Different states have different requirements for operating a microlending business. To ensure compliance, you must obtain the necessary tax identification numbers, licenses, and permits. Here’s how to go about it:

- Business Licenses: Most states require a general business license. Check with your local government for specifics.

- Loan Originator Licenses: Depending on your state, you may need a license to originate loans. This is especially important for microlending.

- Compliance with Lending Laws: Familiarize yourself with state and federal lending laws to ensure your business practices align.

Staying compliant not only protects you legally but also builds trust with your clients. Here’s a quick reference table of common licenses and permits you might need:

| License/Permit | Description | Required by |

|---|---|---|

| Business License | General license to operate a business | Local government |

| Loan Originator License | License to originate loans | State financial authority |

| EIN | Employer Identification Number for tax purposes | IRS |

Make sure to check with your local and state regulations to ensure you have all the necessary paperwork in place. This diligence will save you from potential fines and legal issues down the road.

9. Set Up Your Financial Management Systems for How to Start a Microlending Business

Implementing sound financial practices is essential for your microlending operation. A robust financial management system will help you track loans, repayments, and operational costs efficiently. Here are some key components to consider:

- Accounting Software: Invest in reliable accounting software that can help you manage your books, track income, and monitor expenses. Popular options include QuickBooks, FreshBooks, and Xero.

- Separate Business Bank Account: Open a dedicated bank account for your microlending business to keep personal and business finances separate.

- Budgeting: Establish a budget that outlines your expected income and expenses. This will help you manage cash flow and plan for future growth.

To give you a clearer picture, here’s a simple table outlining the components of an effective financial management system:

| Component | Description | Benefits |

|---|---|---|

| Accounting Software | Tools for tracking finances | Streamlines bookkeeping and reporting |

| Business Bank Account | Separate account for business transactions | Improves financial clarity and organization |

| Budgeting | Plan for income and expenses | Helps manage cash flow and avoid overspending |

Establishing these systems early will not only make your life easier but will also ensure you remain compliant with financial regulations.

10. Establish Your Brand Identity for Your Microlending Business

Your brand is more than just a logo; it’s how your customers perceive your microlending business. Establishing a strong brand identity is crucial for attracting clients and building trust. Here are some steps to create a compelling brand:

- Create a Logo: Design a logo that represents your mission and values. A professional logo can make a lasting impression.

- Develop a Consistent Voice: Your marketing materials, website, and social media should all communicate in a consistent tone that reflects your brand.

- Engage with Your Community: Building relationships within your target community can enhance your brand’s reputation and trustworthiness.

To help you visualize your branding efforts, consider the following table that outlines key elements of brand identity:

| Brand Element | Description | Importance |

|---|---|---|

| Logo | Visual representation of your brand | Creates first impressions and brand recognition |

| Brand Voice | Communication style used in messaging | Builds consistency and trust with customers |

| Community Engagement | Interaction with local audience | Enhances reputation and fosters loyalty |

A strong brand identity can set you apart from competitors and help you connect with your target audience in meaningful ways.

11. Develop a Professional Website for Your Microlending Business

In today’s digital age, having a professional website is crucial for your microlending business. Your website serves as the face of your operation, providing potential borrowers with essential information about your services. Here are some key elements to consider when developing your site:

- User-Friendly Design: Ensure your website is easy to navigate. A clean layout with clear menus will help visitors find what they need quickly.

- Informative Content: Provide detailed information about your loan products, application processes, and eligibility criteria. Transparency builds trust.

- Contact Information: Make sure your contact details are easily accessible. Consider adding a chat feature for instant support.

Here’s a simple checklist to ensure your website meets the needs of your audience:

- Responsive design for mobile users.

- Secure application forms for loan requests.

- Blog section for educational content on financial literacy.

A well-crafted website can significantly enhance your brand’s visibility and credibility in the microlending market.

12. Market and Advertise Your Microlending Business

To attract borrowers, you need to market effectively. Here are some strategies to consider for promoting your microlending business:

- Social Media Advertising: Platforms like Facebook and Instagram can help you reach a broader audience. Create engaging posts that highlight success stories and loan offerings.

- Networking: Connect with local businesses and community organizations. Attend events to build relationships and promote your services.

- Content Marketing: Create informative content, such as blog posts or videos, that educate your audience on financial literacy and the benefits of microlending.

To visualize your marketing efforts, consider the following table outlining different marketing channels and their benefits:

| Marketing Channel | Description | Benefits |

|---|---|---|

| Social Media | Engaging with potential clients online | Increased visibility and brand awareness |

| Networking | Building relationships within the community | Trust and referral opportunities |

| Content Marketing | Providing valuable information to your audience | Establishes authority and attracts clients |

By implementing these strategies, you can effectively market your microlending business and reach those who need your services.

13. Assemble Your Team for Your Microlending Business

As your microlending business grows, you’ll need to build a strong team to support your operations. Consider hiring the following key positions:

- Loan Officers: Responsible for managing loan applications and conducting assessments.

- Marketing Professionals: Focus on promoting your business and attracting new clients.

- Financial Advisors: Ensure compliance with regulations and provide guidance on financial practices.

Having a capable team is crucial for your business’s success. Here’s a quick list of qualities to look for when hiring:

- Experience in finance or microlending.

- Strong communication skills.

- Commitment to customer service.

Investing in the right people will help you build a reputable microlending business that can thrive in a competitive market. Remember, your team is your greatest asset!

Conclusion

Starting a microlending business can be a rewarding venture that not only generates income but also contributes positively to your community. By following the steps outlined in this article—from developing a solid business model to assembling a competent team—you can lay the groundwork for a successful operation. Remember, the journey of microlending is about empowering individuals and fostering financial inclusion.

For further insights, I recommend checking out our articles on creating a SWOT Analysis for Microlending and how to begin a Microlending Marketing Plan. These resources will provide you with valuable strategies to enhance your business approach and effectiveness.

FAQ

- What is microlending?

Microlending is the practice of providing small loans to individuals or businesses that do not have access to traditional banking services, helping them to start or expand their ventures. - How do I start a microlending business?

To start a microlending business, develop a solid business model, conduct market research, secure funding, and ensure compliance with local regulations. - What are the legal requirements for microlending?

Legal requirements vary by region but typically include obtaining necessary licenses, permits, and adhering to lending regulations and consumer protection laws. - How can I attract borrowers to my microlending business?

Effective marketing strategies, such as utilizing social media, networking within the community, and providing valuable educational content, can help attract borrowers. - What types of loans can I offer?

You can offer various types of loans, including fixed loans, revolving credit, and specialized loans tailored to specific groups, such as women entrepreneurs or green businesses. - What are the risks associated with microlending?

Risks include borrower default, regulatory changes, and market competition. Implementing strong financial management practices can help mitigate these risks. - How do I manage loan repayments?

Establish clear repayment terms and utilize accounting software to track payments. Consider offering flexible repayment plans to accommodate borrowers. - Can I use technology in my microlending business?

Yes, technology can streamline operations, improve customer experience, and enhance your marketing efforts. Consider using online platforms for applications and loan management. - What is the impact of microlending?

Microlending can significantly impact local economies by providing access to capital, fostering entrepreneurship, and promoting financial inclusion. - How do I measure the success of my microlending business?

Success can be measured through various metrics, including loan repayment rates, customer satisfaction, and overall financial performance.