Why Should You Have a SWOT Analysis for Offshore Banking?

Are you considering using an offshore bank? You’re not alone! Many individuals and businesses are exploring offshore banking for its potential benefits like asset protection, privacy, and tax advantages. But did you know that without a proper SWOT analysis, you might be missing out on critical insights? A SWOT analysis for offshore banks helps you identify their strengths, weaknesses, opportunities, and threats. It’s like having a roadmap that guides your decisions and strategies.

- Understand the advantages of offshore banking.

- Identify potential risks and weaknesses.

- Explore opportunities for financial growth.

- Analyze the competition in the offshore banking sector.

- Create strategies to mitigate threats.

- Use real-world examples to inform your analysis.

- Enhance decision-making with data-driven insights.

- Tailor your banking approach to your needs.

- Maximize benefits while minimizing risks.

- Stay informed about regulatory changes.

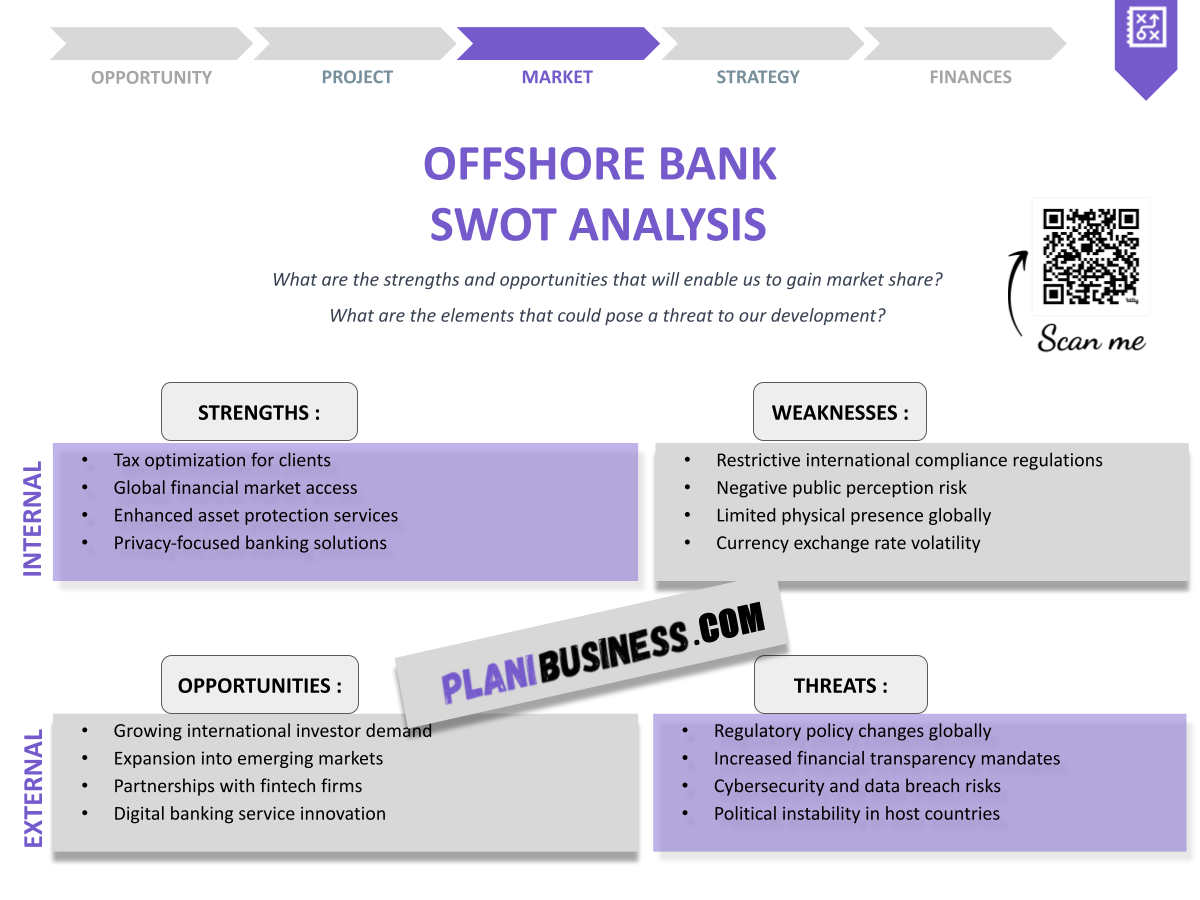

How Do You Write a SWOT Analysis for Offshore Banks?

Creating a SWOT analysis for offshore banks involves a structured approach. Here’s how to break it down:

Strengths

Offshore banks offer confidentiality and privacy. This is a major draw for clients looking to protect their financial information. Additionally, the ability to diversify assets allows clients to spread risk across different jurisdictions. Many offshore banks also provide access to international investment opportunities that may not be available domestically. Finally, strong regulatory frameworks in some jurisdictions can enhance the stability and reliability of offshore banks.

Weaknesses

High fees and minimum deposit requirements can be a barrier for some potential clients. Moreover, limited access to certain financial services may frustrate clients who are used to full-service banks. Regulatory changes can affect the viability of offshore banking options, and misunderstandings about tax implications can lead to compliance issues.

Opportunities

The growing trend of global mobility presents opportunities for offshore banks to attract clients. Advances in technology allow for enhanced banking services and customer experiences. Increasing awareness of asset protection strategies can drive more clients to consider offshore options. Finally, collaboration with fintech companies can create innovative banking solutions.

Threats

Increased scrutiny and regulation from governments can pose challenges to offshore banks. Negative perceptions of offshore banking as tax evasion can damage reputations. Economic downturns in key markets can impact the stability of offshore banks, and competition from domestic banks offering similar services can threaten market share.

SWOT Example N°1 for Offshore Bank A

This example illustrates how Offshore Bank A capitalizes on its strengths while addressing weaknesses.

| SWOT | Analysis |

|---|---|

| Strengths | High customer satisfaction |

| Weaknesses | Limited product offerings |

| Opportunities | Expanding into emerging markets |

| Threats | Regulatory changes |

- High customer satisfaction.

- Limited product offerings.

- Expanding into emerging markets.

- Facing regulatory changes.

Offshore Bank A shows a solid customer base but must diversify its offerings to compete effectively. It's crucial for them to leverage emerging markets while navigating the changing regulations.

SWOT Example N°2 for Offshore Bank B

An evaluation of Offshore Bank B reveals its unique position in the market.

| SWOT | Analysis |

|---|---|

| Strengths | Innovative digital banking |

| Weaknesses | High fees |

| Opportunities | Growing tech-savvy clientele |

| Threats | Cybersecurity risks |

- Innovative digital banking solutions.

- High fees deter some clients.

- Tech-savvy clientele growth.

- Cybersecurity risks.

Offshore Bank B excels in digital banking but must address its fee structure to attract a broader audience. Cybersecurity remains a significant concern as they innovate.

SWOT Example N°3 for Offshore Bank C

The analysis of Offshore Bank C highlights its strategic advantages in the offshore banking sector.

| SWOT | Analysis |

|---|---|

| Strengths | Strong international presence |

| Weaknesses | Complex account setup |

| Opportunities | Partnerships with local firms |

| Threats | Competition from local banks |

- Strong international presence.

- Complex account setup process.

- Potential partnerships with local firms.

- Competition from local banks.

Offshore Bank C's global reach is impressive, but the complexity of opening accounts could deter potential clients. Strategic partnerships could enhance their local market presence.

SWOT Example N°4 for Offshore Bank D

The SWOT analysis for Offshore Bank D showcases its growth potential and client-focused strategies.

| SWOT | Analysis |

|---|---|

| Strengths | Personalized customer service |

| Weaknesses | Limited marketing outreach |

| Opportunities | Growing demand for financial education |

| Threats | Changes in client preferences |

- Personalized customer service.

- Limited marketing outreach.

- Demand for financial education.

- Shifting client preferences.

Offshore Bank D's personalized service is a strength, but it needs to ramp up marketing efforts to attract new clients. Meeting the demand for financial education could also set them apart.

SWOT Example N°5 for Offshore Bank E

The evaluation of Offshore Bank E reveals critical insights into its operations and market position.

| SWOT | Analysis |

|---|---|

| Strengths | Robust security measures |

| Weaknesses | High operational costs |

| Opportunities | Expanding service offerings |

| Threats | Increasing regulatory scrutiny |

- Robust security measures.

- High operational costs.

- Expanding service offerings.

- Regulatory scrutiny.

While Offshore Bank E excels in security, its operational costs may hinder competitiveness. They should consider expanding service offerings to capture more market share.

SWOT Example N°6 for Offshore Bank F

The SWOT analysis for Offshore Bank F demonstrates its market positioning and competitive advantages.

| SWOT | Analysis |

|---|---|

| Strengths | Competitive interest rates |

| Weaknesses | Slow customer service |

| Opportunities | Entry into new markets |

| Threats | Economic fluctuations |

- Competitive interest rates.

- Slow customer service response.

- Opportunities in new markets.

- Vulnerable to economic changes.

Offshore Bank F's attractive interest rates are a strength, but slow service could deter clients. Exploring new markets may present growth opportunities amidst economic fluctuations.

SWOT Example N°7 for Offshore Bank G

The analysis of Offshore Bank G uncovers its strategic focus and competitive landscape.

| SWOT | Analysis |

|---|---|

| Strengths | Strong brand reputation |

| Weaknesses | Limited geographic reach |

| Opportunities | Growing demand for offshore banking services |

| Threats | Reputation risks |

- Strong brand reputation.

- Limited geographic presence.

- Demand for offshore banking services.

- Risks to reputation.

Offshore Bank G benefits from a solid reputation but must expand geographically to tap into rising demand for offshore services. Managing reputation risks is crucial for maintaining trust.

SWOT Example N°8 for Offshore Bank H

An evaluation of Offshore Bank H highlights its unique challenges and opportunities in the market.

| SWOT | Analysis |

|---|---|

| Strengths | Innovative service offerings |

| Weaknesses | High customer turnover |

| Opportunities | Increasing awareness of offshore banking |

| Threats | Regulatory changes |

- Innovative service offerings.

- High customer turnover.

- Growing awareness of offshore options.

- Regulatory challenges.

While Offshore Bank H offers innovative services, high turnover is concerning. They need to capitalize on the growing awareness of offshore banking while navigating regulatory changes.

SWOT Example N°9 for Offshore Bank I

The SWOT analysis for Offshore Bank I highlights its operational efficiency and market challenges.

| SWOT | Analysis |

|---|---|

| Strengths | Efficient operational processes |

| Weaknesses | Limited technology adoption |

| Opportunities | Growth in digital banking |

| Threats | Competition from tech-savvy banks |

- Efficient processes.

- Limited technology use.

- Digital banking growth opportunities.

- Tech-savvy competition.

Offshore Bank I's operational efficiency is commendable, but they must adopt technology to stay competitive. The digital banking growth trend is an opportunity they shouldn't miss.

SWOT Example N°10 for Offshore Bank J

The evaluation of Offshore Bank J showcases its niche market approach and associated risks.

| SWOT | Analysis |

|---|---|

| Strengths | Niche market expertise |

| Weaknesses | Dependence on specific clientele |

| Opportunities | Expansion into related niches |

| Threats | Market saturation |

- Niche market expertise.

- Dependence on a specific clientele.

- Opportunities for niche expansion.

- Risk of market saturation.

Offshore Bank J excels in its niche but relies heavily on a specific client base. Expanding into related niches could mitigate risks associated with market saturation.

Conclusion: Summarizing the Importance of Offshore Bank SWOT Analysis

In conclusion, conducting a SWOT analysis for offshore banks is essential for informed decision-making. By understanding strengths, weaknesses, opportunities, and threats, you can navigate the complexities of offshore banking with confidence. Whether you’re an individual or a business, this analysis empowers you to maximize benefits while minimizing risks. If you are looking to establish a strong foundation for your venture, consider using this business plan template for Offshore Bank that provides a comprehensive structure for your business strategy.

Additionally, if you want to learn more about the process, check out our articles on How to Initiate an Offshore Bank? and How to Formulate an Offshore Bank Marketing Plan? With Example. These resources will further guide you in your journey through the world of offshore banking.

FAQ

1. What is a SWOT analysis?

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats of an organization or strategy, providing a comprehensive overview.

2. Why is a SWOT analysis crucial for offshore banks?

This analysis helps identify key factors that influence performance and guides strategic decision-making in the offshore banking sector.

3. How frequently should a SWOT analysis be conducted?

It should be conducted regularly, ideally at least once a year, or whenever significant changes occur in the market or the organization.

4. What common strengths do offshore banks possess?

Common strengths include confidentiality, asset diversification, and access to international markets, which can enhance financial security.

5. What weaknesses might offshore banks encounter?

Typical weaknesses include high fees, limited services, and potential compliance issues due to regulatory changes.

6. What opportunities are available for offshore banks?

There are numerous opportunities, including emerging markets, technological advancements, and increased awareness of asset protection strategies.

7. What threats do offshore banks face?

Threats include increased regulatory scrutiny, negative public perceptions of offshore banking, and competition from domestic financial institutions.

8. How can I utilize a SWOT analysis in my decision-making?

By identifying key factors, a SWOT analysis enables you to make informed choices about banking strategies and operational improvements.

9. What is the best way to present a SWOT analysis?

Using clear tables and bullet points enhances readability and understanding, making it easier to digest the information.

10. Can a SWOT analysis change over time?

Yes, it should evolve as market conditions, regulatory environments, and organizational capabilities change.