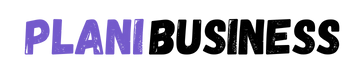

Why Should You Have a SWOT Analysis for Real Estate Investment?

Are you considering jumping into the real estate market? You’re not alone! In fact, over 90% of investors believe that a SWOT analysis is essential for making informed decisions. Understanding the strengths, weaknesses, opportunities, and threats in your investment strategy can make or break your success.

A SWOT analysis helps you identify internal and external factors affecting your real estate investment. By evaluating these elements, you can create a robust strategy that enhances your investment decisions. This analysis not only provides clarity on where you stand but also opens doors to new possibilities in the real estate market.

10 Key Points of the Article:

- Understanding SWOT analysis in real estate.

- Importance of identifying strengths.

- Recognizing weaknesses to mitigate risks.

- Exploring opportunities for growth.

- Assessing threats in the market.

- Real-life examples of effective SWOT strategies.

- How to conduct a SWOT analysis.

- Tips for optimizing your investment strategy.

- Common pitfalls to avoid in real estate investment.

- Final thoughts on leveraging SWOT for success.

How Do You Write a SWOT Analysis for Real Estate Investment?

Creating a SWOT analysis can seem daunting, but it’s all about breaking it down into manageable parts. Here’s how to tackle each section:

Strengths

1. Strong Market Position: Many investors have established a solid reputation, attracting quality tenants.

2. Diverse Portfolio: A mix of residential and commercial properties can reduce risk.

3. Financial Stability: Access to capital allows for quick decisions on potential investments.

4. Expertise in Local Markets: Knowledge of neighborhood trends can lead to better investment choices.

Weaknesses

1. High Maintenance Costs: Older properties may require significant repairs.

2. Market Volatility: Real estate values can fluctuate based on economic conditions.

3. Limited Cash Flow: Some investments may not generate immediate returns.

4. Overleveraging: Relying too heavily on loans can lead to financial strain.

Opportunities

1. Emerging Markets: Investing in up-and-coming neighborhoods can yield high returns.

2. Tax Incentives: Various tax breaks can improve profitability.

3. Technological Advancements: Utilizing property management software can streamline operations.

4. Sustainable Practices: Green building initiatives can attract eco-conscious tenants.

Threats

1. Economic Downturns: Recessions can decrease property values.

2. Regulatory Changes: New laws can impact rental income.

3. Increased Competition: More investors entering the market can drive prices up.

4. Natural Disasters: Properties in vulnerable areas face higher risks.

SWOT Example N°1 for Real Estate Investment

Let’s take a look at a successful real estate investment strategy that utilized a SWOT analysis effectively.

| SWOT | Analysis |

|---|---|

| Strengths | Established brand, loyal clientele |

| Weaknesses | Limited online presence |

| Opportunities | Expansion into new markets |

| Threats | Economic recession |

Resume-Liste:

- Strong brand recognition boosts investor confidence.

- Online marketing strategies can enhance visibility.

- New market exploration opens revenue streams.

- Economic fluctuations pose risks.

This example showcases how leveraging a strong brand can mitigate weaknesses in digital presence. The opportunity for market expansion highlights the potential for growth, but the threat of economic downturns remains a concern.

SWOT Example N°2 for Real Estate Investment

Here’s another example that illustrates the importance of conducting a thorough SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Prime location, high demand |

| Weaknesses | Aging infrastructure |

| Opportunities | Development grants available |

| Threats | Rising interest rates |

Resume-Liste:

- Prime locations ensure high rental demand.

- Infrastructure upgrades can attract more tenants.

- Development grants provide financial support.

- Interest rates can affect borrowing costs.

This example emphasizes the significance of location in real estate investment. The opportunity for development grants can alleviate some weaknesses, but rising interest rates present a significant threat to profitability.

SWOT Example N°3 for Real Estate Investment

Let’s examine a different angle with this SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Diversified property types |

| Weaknesses | High vacancy rates |

| Opportunities | Increased demand for rentals |

| Threats | Changing tenant preferences |

Resume-Liste:

- Diversification reduces overall risk.

- Addressing vacancy rates can improve cash flow.

- Rental demand is on the rise.

- Understanding tenant preferences is crucial.

This example shows that diversification can be a strength in real estate. However, high vacancy rates can be a concern that needs addressing, especially in a changing market.

SWOT Example N°4 for Real Estate Investment

Here’s another insightful SWOT analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Experienced management team |

| Weaknesses | Limited marketing budget |

| Opportunities | Partnerships with local businesses |

| Threats | Economic instability |

Resume-Liste:

- An experienced management team can streamline operations.

- Marketing budget limitations can hinder growth.

- Partnerships can enhance community engagement.

- Economic instability can impact tenant retention.

This example highlights the value of having a strong management team. However, it also points out that limited marketing resources can restrict growth opportunities in a volatile economic climate.

SWOT Example N°5 for Real Estate Investment

Continuing on, this SWOT analysis presents a unique perspective.

| SWOT | Analysis |

|---|---|

| Strengths | Strong community ties |

| Weaknesses | Limited access to funding |

| Opportunities | Growing interest in community housing |

| Threats | New regulations affecting rentals |

Resume-Liste:

- Community ties enhance tenant loyalty.

- Property management experience is vital for efficiency.

- Community housing initiatives can attract investment.

- Regulations can impact profitability.

This analysis demonstrates how community ties can bolster tenant loyalty, while also stressing the need for property management expertise in navigating regulatory challenges.

SWOT Example N°6 for Real Estate Investment

Here’s yet another example to consider.

| SWOT | Analysis |

|---|---|

| Strengths | Innovative property designs |

| Weaknesses | Higher construction costs |

| Opportunities | Demand for unique living spaces |

| Threats | Market saturation |

Resume-Liste:

- Innovative designs can attract niche markets.

- Higher costs may affect profit margins.

- Unique spaces are increasingly sought after.

- Market saturation can lead to fierce competition.

This SWOT analysis shows the benefits of creativity in property design. However, the risk of market saturation could threaten profitability, making careful planning essential.

SWOT Example N°7 for Real Estate Investment

Let’s look at another practical example.

| SWOT | Analysis |

|---|---|

| Strengths | Strong online presence |

| Weaknesses | Dependence on single market |

| Opportunities | Expansion into new regions |

| Threats | Competitors enhancing their online strategies |

Resume-Liste:

- An online presence can boost visibility and leads.

- Market dependence can be risky.

- Expanding into new areas can diversify risk.

- Competitors may adapt quickly to market changes.

This example illustrates the importance of a strong online presence while also recognizing the risks associated with market dependence and competition.

SWOT Example N°8 for Real Estate Investment

Here’s a compelling SWOT analysis to consider.

| SWOT | Analysis |

|---|---|

| Strengths | Strong investor network |

| Weaknesses | Limited access to funding |

| Opportunities | Crowdfunding options |

| Threats | Economic downturns |

Resume-Liste:

- A strong network can facilitate investment opportunities.

- Funding limitations can restrict growth.

- Crowdfunding can offer new capital sources.

- Economic downturns pose risks to all investors.

This example highlights the significance of networking in real estate while also addressing the challenges of funding and economic risks.

SWOT Example N°9 for Real Estate Investment

Let’s delve into another insightful analysis.

| SWOT | Analysis |

|---|---|

| Strengths | Established rental income |

| Weaknesses | Aging property conditions |

| Opportunities | Renovation tax credits |

| Threats | Rising maintenance costs |

Resume-Liste:

- Established income provides financial stability.

- Property conditions can affect tenant retention.

- Renovation credits can incentivize improvements.

- Maintenance costs can impact profitability.

This analysis emphasizes the balance between established income and the need for property upkeep, illustrating the importance of managing maintenance expenses effectively.

SWOT Example N°10 for Real Estate Investment

Here’s the final SWOT analysis example.

| SWOT | Analysis |

|---|---|

| Strengths | High tenant satisfaction |

| Weaknesses | Overdependence on short-term leases |

| Opportunities | Long-term lease agreements |

| Threats | Economic instability affecting tenants |

Resume-Liste:

- High satisfaction can lead to tenant retention.

- Short-term leases can create income variability.

- Long-term agreements provide stability.

- Economic factors can impact tenant ability to pay.

This example illustrates the importance of tenant satisfaction while also addressing the challenges of lease structures and economic influences on rental income.

Conclusion and Call to Action

In conclusion, conducting a Real Estate Investment SWOT Analysis can provide invaluable insights into your investment strategy. By identifying your strengths, weaknesses, opportunities, and threats, you can make informed decisions that enhance your success in the market. This analytical approach not only helps you understand your current position but also prepares you for future challenges and opportunities.

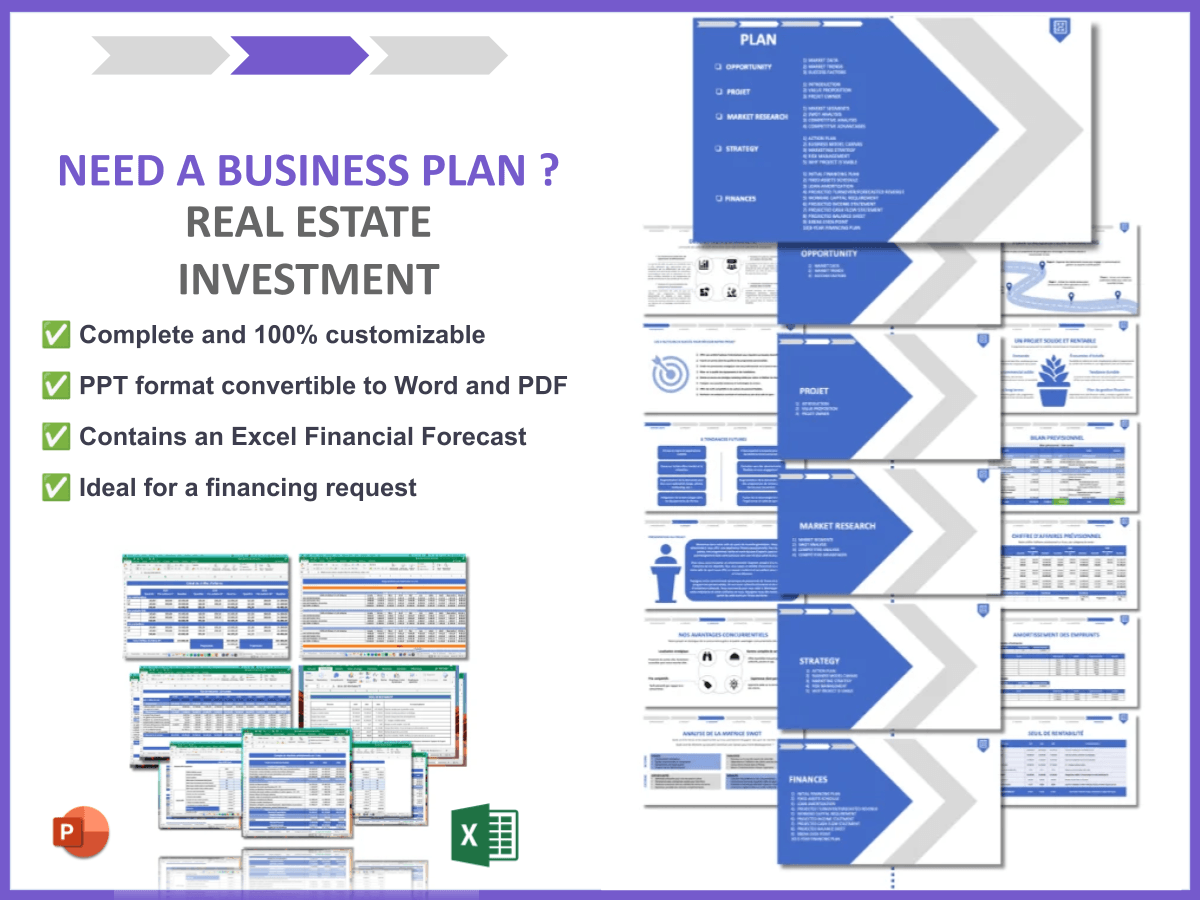

To further assist you in your journey, consider checking out this business plan template for Real Estate Investment. It’s a valuable resource that can streamline your planning process and set you on the path to success.

Additionally, you might find our articles helpful:

How to Build a Real Estate Investment Business?

and

How to Formulate a Real Estate Investment Marketing Plan? With Example.

Frequently Asked Questions

1. What does a SWOT analysis in real estate investment involve?

A SWOT analysis in real estate investment involves evaluating strengths, weaknesses, opportunities, and threats related to your investment strategy, helping you make informed decisions.

2. Why is it essential to conduct a SWOT analysis?

Conducting a SWOT analysis is crucial as it allows investors to gain insights into their market position and make strategic decisions to maximize their investment potential.

3. How frequently should I perform a SWOT analysis?

It is recommended to perform a SWOT analysis annually or whenever significant changes occur in your investment strategy or the market conditions.

4. What are some common strengths identified in real estate?

Common strengths in real estate include a strong market position, a diversified portfolio, and financial stability.

5. How can I address weaknesses found in my analysis?

To address weaknesses, identify specific areas for improvement and develop strategies to mitigate those weaknesses, such as enhancing marketing efforts or improving property management.

6. What types of opportunities should I be looking for?

Look for emerging markets, tax incentives, and advancements in technology that can enhance property management and tenant satisfaction.

7. How can I identify potential threats in my market?

Stay informed about economic trends, regulatory changes, and market dynamics to anticipate potential threats to your real estate investment.

8. Is it possible to use SWOT analysis for other investments?

Yes, SWOT analysis is a versatile tool that can be applied to various types of investments beyond just real estate.

9. What should I do after completing my SWOT analysis?

After completing a SWOT analysis, use the insights gained to create a strategic plan that leverages your strengths and opportunities while addressing weaknesses and threats.

10. Are there tools available to help with SWOT analysis?

Yes, numerous templates and software tools are available that can assist you in conducting a thorough SWOT analysis, making the process easier and more efficient.