Why Should You Have a SWOT Analysis for a Savings Bank?

Are you managing a savings bank and wondering how to navigate the complex financial landscape? You’re not alone! Many financial institutions face challenges that can be addressed through strategic analysis. In fact, a recent study found that 70% of banks that performed a SWOT analysis reported improved decision-making and strategic planning.

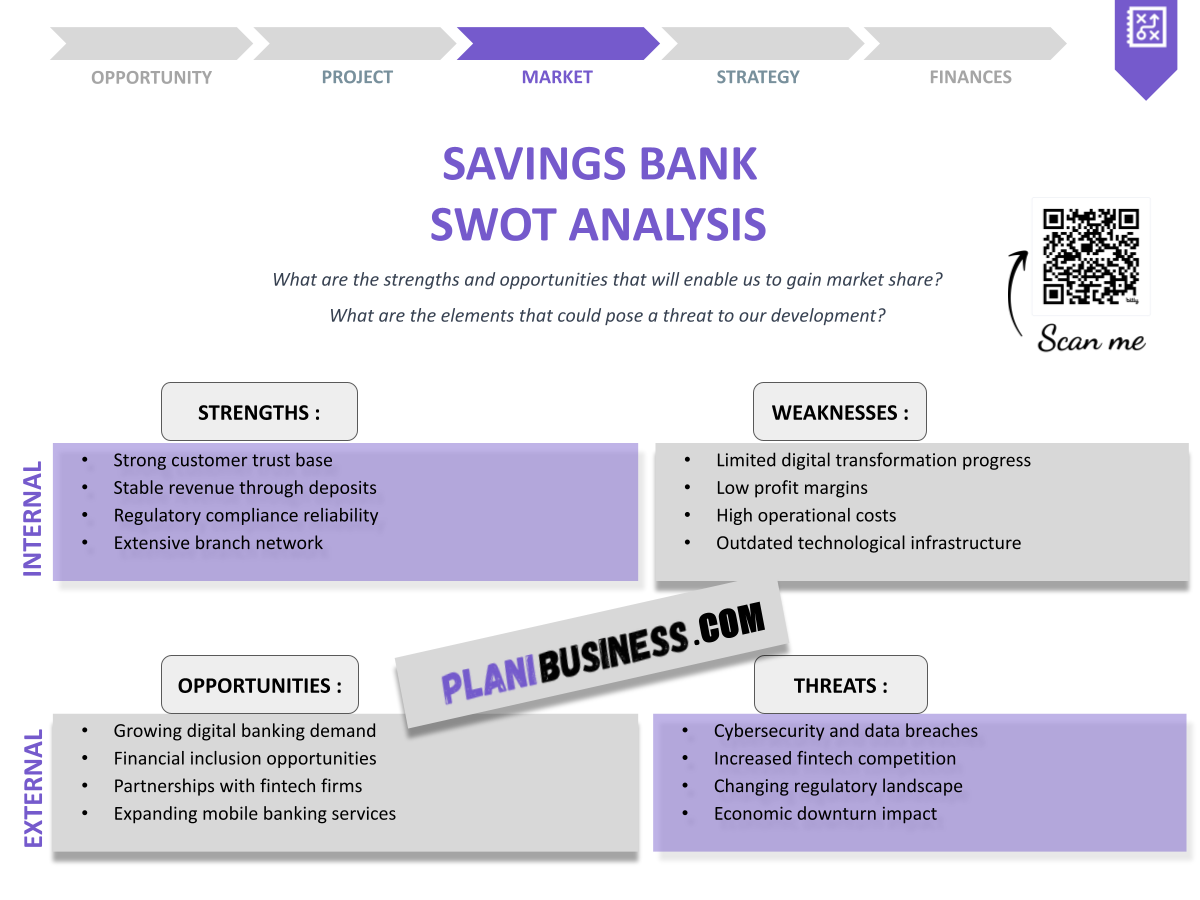

A SWOT analysis is a structured planning method that evaluates the Strengths, Weaknesses, Opportunities, and Threats related to a business or project. It helps organizations identify internal and external factors that can impact their success.

- Clarifies the bank’s strategic direction.

- Identifies competitive advantages.

- Highlights areas for improvement.

- Uncovers market opportunities.

- Assesses potential risks.

- Enhances decision-making.

- Supports resource allocation.

- Improves stakeholder communication.

- Encourages proactive strategies.

- Fosters a culture of continuous improvement.

How Do You Write a SWOT Analysis for a Savings Bank?

Writing a SWOT analysis involves gathering insights from various stakeholders and analyzing the bank’s current position. Here’s how to break it down:

Strengths

Strengths are internal attributes that give your savings bank an advantage over competitors. Consider aspects like:

- Strong customer loyalty and trust.

- Robust financial health and capital reserves.

- Innovative digital banking solutions.

- Skilled workforce with industry experience.

Weaknesses

Weaknesses are internal factors that may hinder your bank’s performance. Examples include:

- Limited branch network compared to competitors.

- High operational costs.

- Dependence on traditional banking methods.

- Lack of brand recognition in certain markets.

Opportunities

Opportunities are external factors that your savings bank can leverage for growth. Some possibilities are:

- Growing demand for online banking services.

- Expansion into underserved markets.

- Partnerships with fintech companies.

- Increasing interest in sustainable banking practices.

Threats

Threats are external challenges that could negatively impact your bank. These might involve:

- Intensifying competition from online banks.

- Regulatory changes affecting operations.

- Economic downturns impacting customer deposits.

- Cybersecurity threats jeopardizing customer data.

SWOT Example N°1 for XYZ Savings Bank

XYZ Savings Bank has successfully implemented a SWOT analysis that revealed key insights about its operations.

| SWOT | Analysis |

|---|---|

| Strengths | Established brand reputation |

| Weaknesses | Limited service offerings |

| Opportunities | Potential for mobile banking |

| Threats | Rising competition |

- Strong community ties.

- Opportunities for service diversification.

- Need for digital transformation.

- Risks associated with competition.

XYZ Savings Bank's established reputation is a significant strength. However, they must expand their service offerings to keep up with the evolving market demands.

SWOT Example N°2 for ABC Savings Bank

ABC Savings Bank’s SWOT analysis highlighted several areas for improvement.

| SWOT | Analysis |

|---|---|

| Strengths | High customer satisfaction |

| Weaknesses | Outdated technology |

| Opportunities | Partnerships with local businesses |

| Threats | Economic instability |

- High levels of customer loyalty.

- Need for technological upgrades.

- Potential for local collaborations.

- Vulnerability to economic fluctuations.

The high customer satisfaction at ABC Savings Bank is commendable. However, the outdated technology poses a significant threat to its competitive position.

SWOT Example N°3 for DEF Savings Bank

DEF Savings Bank’s SWOT analysis showcased its strategic advantages.

| SWOT | Analysis |

|---|---|

| Strengths | Diverse financial products |

| Weaknesses | High employee turnover |

| Opportunities | Growing market for eco-friendly investments |

| Threats | Regulatory compliance issues |

- Wide range of financial products.

- Employee retention challenges.

- Eco-friendly investment opportunities.

- Compliance risks.

DEF Savings Bank’s diverse offerings provide a solid foundation, but addressing employee turnover is crucial for maintaining service quality.

SWOT Example N°4 for GHI Savings Bank

GHI Savings Bank’s SWOT analysis revealed essential insights.

| SWOT | Analysis |

|---|---|

| Strengths | Strong community engagement |

| Weaknesses | Limited marketing reach |

| Opportunities | Digital marketing initiatives |

| Threats | Increased regulatory scrutiny |

- Active community involvement.

- Challenges in marketing outreach.

- Digital growth potential.

- Regulatory challenges.

GHI Savings Bank's community engagement is a strength, but they need to enhance their marketing strategies to reach a broader audience.

SWOT Example N°5 for JKL Savings Bank

JKL Savings Bank’s SWOT analysis illustrated critical operational aspects.

| SWOT | Analysis |

|---|---|

| Strengths | Financial stability |

| Weaknesses | Limited product awareness |

| Opportunities | Expansion into new markets |

| Threats | Market saturation |

- Financial stability is a key advantage.

- Need to improve product awareness.

- Opportunities for market expansion.

- Threat from market saturation.

The financial stability of JKL Savings Bank is a strong point, but they must work on increasing product awareness to attract more customers.

SWOT Example N°6 for MNO Savings Bank

MNO Savings Bank’s SWOT analysis provided valuable insights.

| SWOT | Analysis |

|---|---|

| Strengths | Innovative technology |

| Weaknesses | High fees for services |

| Opportunities | Market for low-fee services |

| Threats | New entrants in the market |

- Technological innovation as a strength.

- Fee structure may deter customers.

- Low-fee service opportunities.

- Competitive threats from new entrants.

MNO Savings Bank's innovative technology is a great asset, but they should consider revising their fee structure to remain competitive.

SWOT Example N°7 for PQR Savings Bank

PQR Savings Bank’s SWOT analysis highlighted key operational strengths.

| SWOT | Analysis |

|---|---|

| Strengths | Strong risk management |

| Weaknesses | Aging infrastructure |

| Opportunities | Upgrading technology |

| Threats | Cybersecurity risks |

- Effective risk management practices.

- Need for infrastructure upgrades.

- Technology upgrade opportunities.

- Cybersecurity threats.

PQR Savings Bank’s strong risk management is commendable. However, aging infrastructure could pose challenges if not addressed promptly.

SWOT Example N°8 for STU Savings Bank

STU Savings Bank’s SWOT analysis revealed essential growth opportunities.

| SWOT | Analysis |

|---|---|

| Strengths | Customer-centric approach |

| Weaknesses | Slow response times |

| Opportunities | Improved customer service |

| Threats | Competitors enhancing services |

- Customer-centric approach as a strength.

- Response time issues.

- Opportunities for service improvement.

- Competitive threats.

STU Savings Bank’s focus on customer satisfaction is a strength, but they must work on improving their response times to enhance customer experience.

SWOT Example N°9 for VWX Savings Bank

VWX Savings Bank’s SWOT analysis highlighted significant aspects.

| SWOT | Analysis |

|---|---|

| Strengths | Experienced management team |

| Weaknesses | Lack of digital presence |

| Opportunities | Growing demand for online services |

| Threats | Increasing competition |

- Experienced management as a strength.

- Digital presence needs enhancement.

- Demand for online services.

- Competitive landscape.

The experienced management team at VWX Savings Bank is a valuable asset. However, they need to strengthen their digital presence to compete effectively.

SWOT Example N°10 for YZA Savings Bank

YZA Savings Bank’s SWOT analysis provided critical insights.

| SWOT | Analysis |

|---|---|

| Strengths | Comprehensive financial services |

| Weaknesses | High operational costs |

| Opportunities | Market for affordable services |

| Threats | Regulatory pressures |

- Comprehensive services as a strength.

- High costs impacting profitability.

- Affordable service opportunities.

- Regulatory challenges.

YZA Savings Bank offers a wide range of financial services, but high operational costs could limit profitability if not managed effectively.

Conclusion: Summarizing the Importance of SWOT Analysis for Savings Banks

In conclusion, conducting a SWOT analysis is essential for savings banks to navigate the complex financial landscape. By identifying strengths, weaknesses, opportunities, and threats, banks can create strategic plans that enhance performance and customer satisfaction. To further support your business endeavors, consider using this business plan template for Savings Bank that can help you outline your goals and strategies effectively.

Additionally, if you’re interested in learning more about how to launch a savings bank, check out our article on How to Launch a Savings Bank? or explore our guide on How to Develop a Savings Bank Marketing Plan? With Example. These resources will provide you with valuable insights and practical tips to help you succeed in the banking industry.

FAQ

What is a SWOT analysis?

A SWOT analysis is a strategic planning tool that helps organizations identify their strengths, weaknesses, opportunities, and threats to better understand their current position.

Why is a SWOT analysis important for savings banks?

It assists savings banks in assessing their competitive position and developing strategies to improve overall performance.

How often should a SWOT analysis be conducted?

It’s advisable to conduct a SWOT analysis annually or whenever significant changes occur within the market or organization.

Who should be involved in the SWOT analysis?

Stakeholders from various departments, including management, finance, and customer service, should be involved to gather diverse insights.

Can SWOT analysis help in risk management?

Yes, by identifying threats, banks can develop strategies to effectively mitigate potential risks.

How can I use SWOT analysis for strategic planning?

Use the insights gained from the SWOT analysis to inform your strategic goals and action plans.

What are some common weaknesses identified in savings banks?

Common weaknesses include high operational costs, outdated technology, and a limited market presence.

How can savings banks leverage opportunities identified in a SWOT analysis?

By developing new products or services that meet market demand or exploring partnerships with fintech companies.

What are the threats facing savings banks today?

Threats include increasing competition, regulatory changes, and economic downturns.

How can I implement a SWOT analysis in my savings bank?

Start by gathering a diverse team, conducting research, and using the SWOT framework to analyze your findings.